Are you struggling with high-interest credit card debt? A balance transfer credit card might be the solution you’re looking for. These cards offer a low or even 0% introductory APR period, allowing you to transfer your existing balances and save money on interest payments. This can be a powerful tool for paying down debt faster and improving your credit score. However, balance transfer cards aren’t a one-size-fits-all solution. It’s essential to understand both the pros and cons of balance transfer credit cards to determine if they’re the right choice for your financial situation.

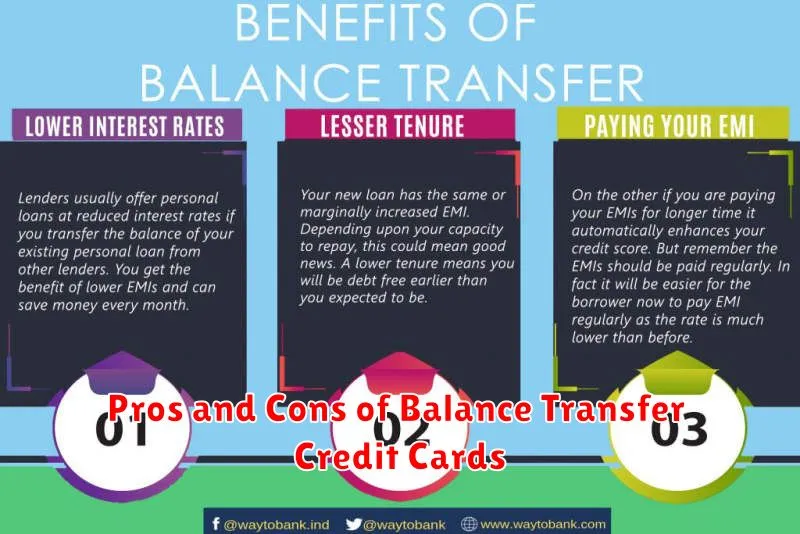

This article will delve into the advantages and disadvantages of balance transfer credit cards, providing a comprehensive overview to help you make an informed decision. We’ll explore the potential benefits, such as significant interest savings and debt consolidation, alongside the potential drawbacks, including balance transfer fees, limited introductory periods, and the risk of accumulating more debt if not managed responsibly. By understanding the pros and cons, you can effectively weigh your options and determine if a balance transfer credit card is the right strategy for achieving your financial goals.

What Is a Balance Transfer?

A balance transfer is the process of moving outstanding debt from one credit account to another. This is most commonly done with credit card debt, where you transfer a balance from a high-interest card to a card with a lower interest rate. The primary goal is to save money on interest payments and potentially pay off the debt faster.

Balance transfers often involve a balance transfer fee, typically a percentage of the amount transferred (e.g., 3-5%). It’s crucial to factor in this fee when evaluating whether a balance transfer is financially beneficial. A lower interest rate may not save you money if the balance transfer fee is too high. Many cards offer introductory 0% APR periods for balance transfers, making them an attractive option for paying down debt quickly before the regular APR kicks in. Pay close attention to the length of the introductory period and the regular APR after it expires.

Before initiating a balance transfer, consider the following: the balance transfer fee, the introductory APR period, the regular APR after the introductory period expires, your credit score (as it impacts approval for a new card), and your ability to pay off the balance within the promotional period.

How It Can Help You Save

Saving money can feel challenging, but employing a few key strategies can make a significant difference. Budgeting is paramount. Carefully tracking your income and expenses allows you to identify areas where you can cut back and allocate funds towards savings goals. Consider using budgeting apps or spreadsheets to simplify this process. Prioritizing needs over wants is also crucial. Differentiating between essential expenses and discretionary spending helps you make informed decisions about where your money goes.

Automating your savings is another effective technique. Setting up automatic transfers from your checking account to a savings account each month ensures consistent contributions, even when you’re busy or tempted to spend. Even small, regular contributions can accumulate significantly over time thanks to the power of compounding interest. Explore different savings vehicles, such as high-yield savings accounts or certificates of deposit, to maximize your returns.

Finally, reducing recurring expenses can free up substantial funds for saving. Negotiating lower rates for services like insurance or cable can lead to significant long-term savings. Cutting back on subscriptions you rarely use or finding more affordable alternatives for everyday purchases can also make a noticeable impact on your budget. By consistently implementing these strategies, you can build a solid financial foundation and achieve your savings objectives.

Understanding Introductory Offers

Introductory offers are short-term promotions designed to attract new customers. Businesses across various industries utilize these offers to incentivize trial and build a customer base. These offers can take many forms, including discounted pricing, free trials, bonus products, or special bundles. The ultimate goal is to present a compelling value proposition that encourages consumers to choose their product or service over competitors.

It’s crucial for consumers to understand the terms and conditions associated with introductory offers. Pay close attention to the duration of the offer, any limitations on usage, and the regular price that will apply after the introductory period ends. Some offers automatically renew at the standard rate, so understanding the cancellation policy is essential to avoid unwanted charges. Careful consideration of these details will ensure that the introductory offer genuinely provides value and aligns with your needs.

While introductory offers can be a great way to save money or experience a new product, it’s important to approach them with a discerning eye. Don’t be swayed solely by the initial discount. Evaluate the overall value and determine whether the product or service is a good fit for you long-term, even at the regular price. Consider whether the offer truly represents a significant saving or simply encourages an unnecessary purchase.

Fees to Watch Out For

When managing your finances, it’s crucial to be aware of various fees that can impact your bottom line. Hidden fees can significantly erode your savings and investments over time. Being vigilant and informed can help you minimize these costs and maximize your financial well-being. Some common fees to watch out for include ATM fees, overdraft fees, and foreign transaction fees.

Investment accounts also come with their own set of fees. Expense ratios for mutual funds and exchange-traded funds (ETFs) represent the annual cost of owning these investments. Advisory fees are charged by financial advisors for managing your portfolio. Commissions are charged per trade when buying or selling stocks, bonds, or other securities. Understanding these fees and how they are calculated is essential for making informed investment decisions.

Finally, be mindful of fees associated with loans and other financial products. Origination fees are charged upfront for processing a loan application. Prepayment penalties can apply if you pay off a loan early. Annual fees are common with credit cards. By carefully reviewing the terms and conditions of any financial product, you can avoid unexpected fees and make sound financial choices.

Steps to Apply Successfully

Preparation is key to a successful application. Carefully review the application requirements, including deadlines and required documents. Gather all necessary materials, such as transcripts, letters of recommendation, and a well-crafted resume/CV. Thoroughly research the organization or program you’re applying to, understanding their mission and values.

Crafting a compelling application is crucial. Tailor your application materials to specifically address the requirements and highlight your relevant skills and experiences. Write a clear and concise statement of purpose or cover letter, showcasing your motivation and fit for the opportunity. Proofread everything meticulously to ensure there are no errors in grammar or spelling.

Submission and follow-up are the final steps. Submit your application before the deadline, following all instructions carefully. If appropriate, follow up with the organization to confirm receipt of your application and inquire about the timeline for decisions. Remain patient and professional throughout the process.

Tips for Paying Off the Balance

Paying off debt can feel overwhelming, but with a strategic approach, you can achieve financial freedom. One of the most effective methods is the debt snowball method. This involves listing all your debts from smallest to largest, regardless of interest rate. Focus on paying off the smallest debt first while making minimum payments on all others. Once the smallest is paid off, roll that payment amount into the next smallest debt, creating a snowball effect. This provides motivation as you see progress and build momentum.

Another popular strategy is the debt avalanche method, which prioritizes debts with the highest interest rates. By tackling the highest-interest debts first, you minimize the overall amount of interest paid over time. This method saves you money in the long run, although it may not offer the same psychological boost as the debt snowball. Calculate the potential savings from each method to determine which best suits your financial situation and personality.

Regardless of the chosen method, certain strategies can accelerate your debt payoff journey. Consider increasing your income through a side hustle or negotiating a raise. Look for opportunities to reduce expenses by creating a budget and identifying areas where you can cut back. Even small changes can make a significant difference over time. Stay committed to your plan, and celebrate your milestones along the way.

Avoiding Traps After Transfer

Relocating can be exciting, but it also presents unique challenges. One common trap is isolation. It’s easy to become overwhelmed by the new environment and neglect building connections. Actively seek out social opportunities, join clubs, and engage with colleagues or neighbors to establish a support system. Don’t be afraid to initiate conversations and put yourself out there.

Another potential pitfall is financial mismanagement. Moving expenses can quickly add up, and unexpected costs may arise. Create a realistic budget that accounts for all potential expenditures, including moving supplies, transportation, housing deposits, and initial living expenses. Track your spending closely and avoid unnecessary purchases during the transition period. Having a financial cushion can also be helpful in navigating unforeseen circumstances.

Finally, beware of the “comparison trap.” It’s natural to compare your new location to your previous one, but dwelling on perceived shortcomings can hinder your adjustment. Focus on the positive aspects of your new environment and embrace the opportunity for growth and exploration. Give yourself time to adapt and avoid making hasty judgments. Remember that building a fulfilling life in a new place takes time and effort.

When It’s Not the Best Option

Sometimes, the seemingly obvious choice isn’t the best one. Several factors can influence this, including unforeseen circumstances, hidden costs, or simply a better alternative emerging. It’s crucial to thoroughly evaluate all available options before making a decision, even if one appears significantly more appealing upfront.

For example, while buying a house might seem like the ideal long-term solution, renting can be more practical in situations with job instability or when living in a rapidly changing market. Similarly, the cheapest option isn’t always the most economical in the long run. A higher initial investment in a more durable product can result in lower maintenance and replacement costs over time.

Ultimately, the best option is the one that best aligns with your specific needs and circumstances. Careful consideration, research, and a willingness to adapt are key to making informed decisions and avoiding potential pitfalls.