Creating a monthly budget is the cornerstone of sound financial management. A well-crafted budget empowers you to track your spending, save for your goals, and build a secure financial future. This guide will walk you through the steps of creating a monthly budget that actually works, transforming your finances from a source of stress to a source of empowerment. Learn how to allocate your income effectively, identify areas for potential savings, and ultimately take control of your financial well-being. Whether you’re struggling with debt, aiming to save for a down payment, or simply seeking to gain a better understanding of your finances, developing a functional monthly budget is the crucial first step.

This practical, step-by-step approach will help you build a monthly budget that is tailored to your specific financial situation. We’ll cover essential aspects such as calculating your income, tracking your expenses, and setting realistic financial goals. You’ll gain valuable insights into prioritizing your spending, identifying unnecessary expenses, and making informed financial decisions. By following this guide, you’ll be well on your way to creating a sustainable monthly budget that not only works but also helps you achieve your financial goals and build a more secure financial future.

The Importance of Budgeting

A budget is a critical tool for managing personal finances. It allows individuals to track their income and expenses, ensuring they are spending within their means. By creating a clear picture of financial inflows and outflows, a budget empowers individuals to make informed decisions about their money, prioritize spending on essential needs, and work towards financial goals such as saving for a down payment, retirement, or paying off debt. Without a budget, it is easy to overspend and accumulate debt, which can lead to financial instability and stress.

Budgeting promotes financial stability. By monitoring spending habits and identifying areas where expenses can be reduced, individuals can gain control of their finances and avoid accumulating unnecessary debt. A well-planned budget acts as a roadmap for achieving financial goals. It allows for the allocation of resources towards specific objectives, such as saving for a down payment on a house or investing in retirement. This proactive approach to financial management fosters discipline and helps prevent impulsive spending, leading to greater financial security and peace of mind.

Creating and maintaining a budget doesn’t have to be complex. Start by tracking income and expenses for a month to understand spending patterns. Then, categorize expenses and set realistic spending limits for each category. Regularly review and adjust the budget as needed to ensure it aligns with changing financial circumstances. Numerous budgeting tools and apps are available to simplify the process and provide a clear overview of financial health. With consistent effort, budgeting becomes an integral part of responsible financial management, contributing to long-term financial well-being.

Identify Your Income Sources

Identifying your income sources is the crucial first step in managing your finances. This involves understanding where your money comes from, whether it’s a salary from employment, interest from investments, rental income, or other sources such as dividends or royalties. A clear picture of your income streams allows for effective budgeting, planning, and ultimately, achieving your financial goals.

Categorizing your income sources can be helpful. For example, you might categorize income as earned (salary, wages, tips, bonuses), passive (rental income, investments), or other (gifts, inheritance). This categorization can help you understand the stability and reliability of your income streams and make informed decisions about your financial future.

Keep accurate records of your income. This includes pay stubs, investment statements, and any other documentation related to your various income sources. This documentation will not only be helpful during tax season but will also provide valuable insights into your overall financial health and progress over time.

Track Every Expense for Accuracy

Maintaining accurate financial records is crucial for both individuals and businesses. Tracking every expense, regardless of size, provides a clear picture of where your money is going, enabling informed financial decisions. This meticulous approach helps identify areas for potential savings, budget adjustments, and reveals spending patterns that may otherwise go unnoticed.

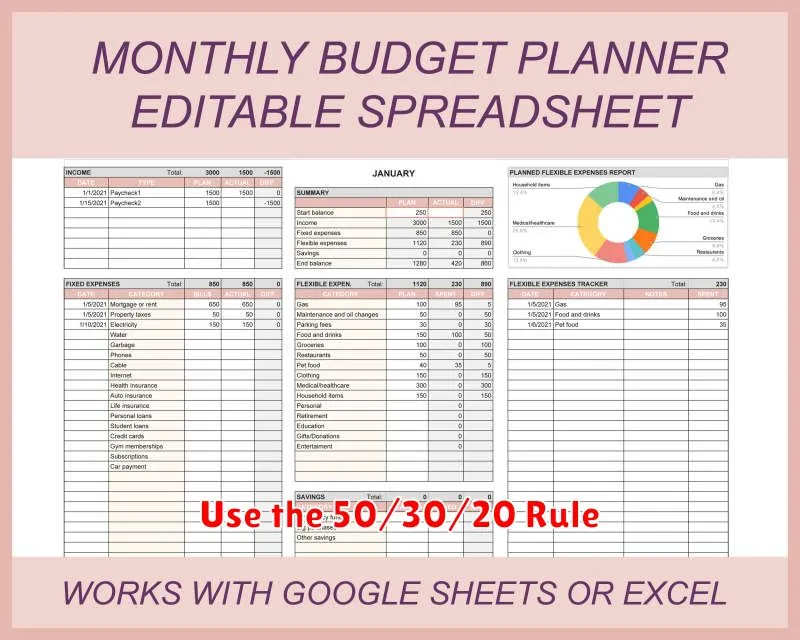

There are various methods for tracking expenses, ranging from simple spreadsheet applications to dedicated budgeting software. Choosing the right method depends on your individual needs and technological comfort. Regardless of the chosen method, ensure that you consistently record each transaction, including the date, amount, vendor, and purpose of the expense. Categorizing expenses can further enhance the analytical value of your records, enabling you to easily identify spending trends across different areas.

Accurate expense tracking is essential for effective budgeting, tax preparation, and financial planning. By diligently monitoring your spending, you can gain control of your finances and work towards achieving your financial goals.

Use the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting method that can help you manage your finances effectively. It allocates your after-tax income into three main categories: needs, wants, and savings or debt repayment. By adhering to these percentages, you can gain better control over your spending and work towards your financial goals.

50% for Needs: This category encompasses your essential expenses. These are the things you must pay for to live comfortably and maintain your current lifestyle. Examples include rent or mortgage payments, groceries, utilities, transportation costs, and health insurance.

30% for Wants: This category covers expenses that enhance your life but aren’t strictly necessary for survival. Think dining out, entertainment, hobbies, and shopping. This is where you have some flexibility to adjust your spending based on your financial situation. 20% for Savings and Debt Repayment: This portion of your income is dedicated to building a secure financial future. It includes savings for emergencies, retirement, down payments, or paying down existing debt, such as credit cards or student loans. Prioritizing this category can help you achieve long-term financial stability.

Adjust for Irregular Costs

Irregular expenses, such as annual insurance premiums, holiday gifts, or car repairs, can disrupt a monthly budget if not accounted for. To manage these unpredictable costs, calculate the annual total for each expense. Then, divide that total by 12 to determine the monthly amount you need to set aside. Consistently saving this smaller amount each month will prevent financial strain when the actual expense arises.

Integrating irregular costs into your budget offers several key benefits. It provides a more accurate picture of your spending, reduces financial stress associated with unexpected bills, and allows you to plan for future expenses more effectively. This proactive approach empowers you to maintain better control over your finances.

Consider setting up a separate savings account specifically for irregular expenses. This further segregates these funds from your regular spending and provides a clear picture of how much you have saved for these anticipated costs.

Tools to Automate Budgeting

Automating your budget can save you significant time and effort, while also helping you stay on top of your finances. Several tools are available to help streamline the process, from dedicated budgeting apps to features built into existing banking platforms. These tools often connect directly to your bank accounts and credit cards, automatically categorizing transactions and providing real-time updates on your spending. They can also help you track your progress toward financial goals, like saving for a down payment or paying off debt, by offering visualizations and progress reports. Automation eliminates the need for manual data entry and provides a clearer picture of your financial health.

Popular budgeting apps offer various features, including customized budget categories, spending alerts, and bill payment reminders. Some even offer investment tracking and net worth calculations. When choosing a tool, consider your specific needs and preferences. Look for features like multi-account syncing, robust security measures, and user-friendly interfaces. Consider the pricing structure as well, as some apps offer free versions with limited features, while others require a paid subscription for full access.

Many banks and credit unions also offer built-in budgeting tools within their online banking platforms. These tools may provide basic budgeting functionalities, such as transaction categorization and spending analysis. While they may not be as comprehensive as dedicated budgeting apps, they offer the convenience of accessing your budget directly through your banking portal. Leveraging these built-in tools can be a good starting point for those new to automated budgeting or seeking a simpler, more integrated approach.

How to Review Your Budget Monthly

Reviewing your budget monthly is crucial for maintaining financial health. Start by comparing your planned spending to your actual spending. Look closely at areas where you overspent or underspent. Consider why these variances occurred. Were there unexpected expenses? Did you stick to your savings goals? This analysis helps you understand your spending habits and identify areas for improvement.

Next, adjust your budget for the upcoming month. Based on your review, modify spending categories as needed. Perhaps you need to allocate more funds to groceries or reduce dining out expenses. If you received a raise or bonus, consider increasing your savings or investment contributions. This proactive approach keeps your budget relevant and aligned with your financial goals.

Finally, track your progress regularly. Utilize budgeting apps, spreadsheets, or notebooks to monitor your spending throughout the month. Regular tracking allows you to identify potential problems early and make necessary adjustments. By staying engaged with your budget, you can ensure you stay on track and achieve your financial objectives.

Building Financial Discipline

Building financial discipline is crucial for achieving long-term financial goals. It involves developing consistent habits related to spending, saving, and managing money effectively. This means making conscious choices about how you use your resources and prioritizing your financial well-being. Cultivating discipline can be challenging, but the rewards are significant, paving the way for a more secure financial future.

Practical steps to build financial discipline include creating a budget and tracking your expenses to understand where your money goes. Setting financial goals, whether short-term like paying off debt or long-term like retirement planning, provides motivation and direction. Automating savings contributions can ensure consistent progress. Finally, regularly reviewing your financial situation and adjusting your strategies as needed is essential for staying on track.

Overcoming common obstacles like impulsive spending requires developing mindfulness about your spending triggers and finding healthy coping mechanisms. Building a support system by discussing your financial goals with family or friends can also provide accountability and encouragement. Remember, building financial discipline is a journey, not a destination. Small, consistent efforts over time will yield significant results.