Deciding whether to lease or buy a car is a significant financial decision. This comprehensive guide explores the pros and cons of both leasing and buying, helping you determine which option best aligns with your individual needs and financial situation. Understanding the key differences between car leasing and car buying is crucial for making an informed choice. We’ll delve into factors such as upfront costs, monthly payments, mileage restrictions, and long-term value to empower you to make the best decision for your transportation needs. Whether you prioritize lower monthly payments or long-term ownership, this guide will provide the clarity you need to choose between leasing vs. buying a car.

From the allure of driving a new car every few years with lower monthly payments that leasing a car offers, to the pride and financial benefits of owning a car outright, each option has its own set of advantages and disadvantages. We’ll break down the complexities of car leases and car purchases, examining everything from depreciation and equity to insurance costs and maintenance responsibilities. By the end of this article, you’ll have the knowledge to confidently navigate the lease vs. buy decision and choose the car acquisition method that perfectly suits your lifestyle and budget. Determining whether to lease or buy a car is a crucial decision, and we’re here to help you make the right one.

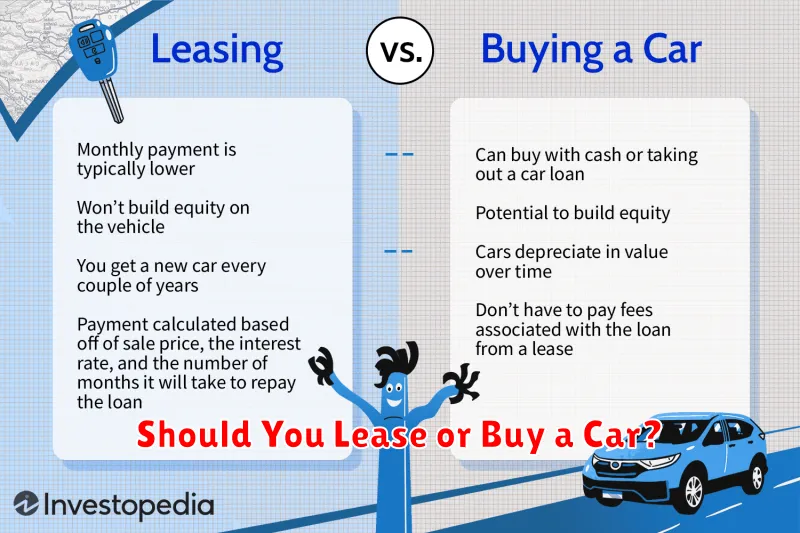

Pros and Cons of Leasing

Leasing offers several advantages. Lower upfront costs are a major draw, requiring a smaller down payment than financing. This frees up capital for other investments. Leasing also typically results in lower monthly payments compared to loans. Furthermore, you’re always driving a relatively new car with the latest features and technology, often covered by the manufacturer’s warranty. At the end of the lease term, you simply return the vehicle, avoiding the hassle of reselling.

However, leasing comes with its downsides. Mileage restrictions are common, incurring extra charges if exceeded. You don’t own the car at the end of the lease term, meaning no equity is built. Customization options are limited, as modifications may need to be reversed before returning the vehicle. Early termination can also result in significant fees. Therefore, leasing requires careful consideration of your driving habits and financial goals.

Ultimately, the decision to lease or buy depends on individual circumstances. If you prioritize lower monthly payments and driving a new car regularly, leasing may be suitable. However, if building equity and ownership are important, financing a purchase might be the better option. Carefully evaluate your needs and budget to make the most informed decision.

Pros and Cons of Buying

Purchasing an item outright offers several advantages. Ownership is perhaps the most significant benefit. You possess the item free and clear, and can use it as you see fit without restrictions. Additionally, buying often involves simpler, one-time transactions. No ongoing payments contribute to better budget management and can improve your credit utilization ratio. Finally, depending on the item, buying can lead to long-term cost savings, especially for durable goods expected to last for many years.

Despite these advantages, buying does have drawbacks. The most prominent is the large upfront cost. This can be a significant financial burden, especially for expensive items. Depreciation is another factor, as many items lose value over time, potentially leading to a financial loss if you decide to resell. Finally, buying may limit flexibility. You are committed to the purchased item, even if your needs or preferences change, unlike leasing or renting which allows for easier upgrades or transitions.

Careful consideration of the pros and cons is crucial before making a purchase. Evaluating your financial situation, the intended use of the item, and the long-term implications of ownership will help you determine if buying is the right choice for you.

How to Compare Monthly Payments

Comparing monthly payments for loans or other financial obligations requires careful consideration of several key factors. Interest rates significantly impact the overall cost and the monthly payment amount. A lower interest rate translates to a lower monthly payment and less interest paid over the life of the loan. Loan terms, or the length of the loan, also play a crucial role. While a longer loan term may result in a lower monthly payment, it typically leads to paying more interest in the long run. Finally, the principal amount, the initial sum borrowed, directly affects the monthly payment. A larger principal amount will generally result in a higher monthly payment, all other things being equal.

To effectively compare monthly payments, utilize online loan calculators or financial planning tools. These resources allow you to input different loan scenarios, including varying interest rates, loan terms, and principal amounts, to quickly see how these factors affect the monthly payment. Carefully review the annual percentage rate (APR), which represents the total cost of borrowing, including fees and interest, expressed as a yearly rate. Focus on the total cost of the loan, not just the monthly payment. A lower monthly payment might seem attractive initially, but a longer loan term could mean paying significantly more interest over time.

By understanding these factors and using available resources, you can confidently compare monthly payments and make informed financial decisions. Don’t hesitate to consult with a financial advisor for personalized guidance.

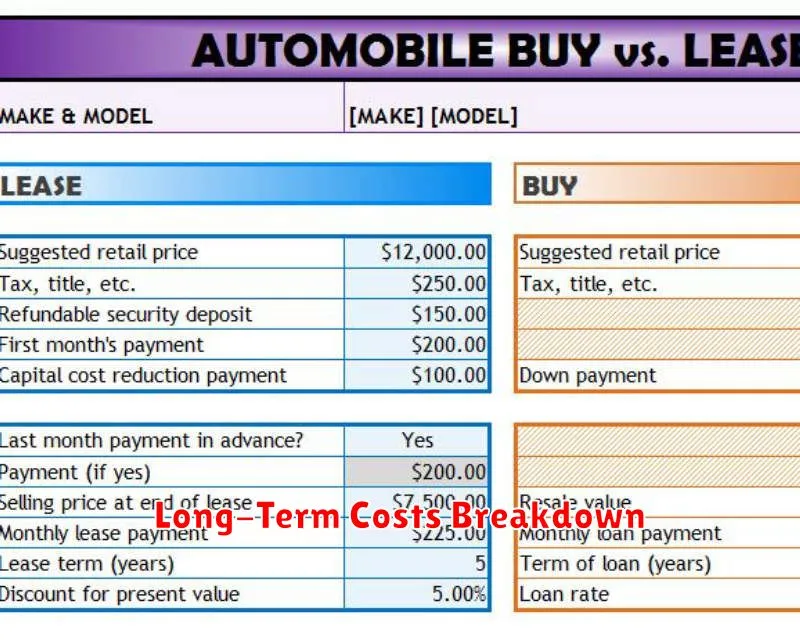

Long-Term Costs Breakdown

Long-term costs encompass expenses projected over an extended period, often associated with significant investments. These costs can include initial outlay, maintenance, operational expenses, and potential replacement or upgrade costs. Accurately forecasting these expenses is crucial for effective budgeting and long-term financial planning. Analyzing long-term costs allows for informed decision-making regarding the viability and profitability of projects or investments.

A comprehensive breakdown of long-term costs typically involves categorizing expenses. Capital expenditures represent the initial investment in assets like equipment or property. Operating expenses cover ongoing costs such as salaries, utilities, and maintenance. Understanding the projected lifespan of assets and their associated maintenance requirements contributes significantly to accurate cost projections. Additionally, factoring in potential inflation and fluctuating market conditions ensures a realistic assessment of future expenses.

By thoroughly evaluating long-term costs, individuals and organizations can make sound financial decisions. This includes choosing between different investment options, prioritizing projects, and allocating resources effectively. A detailed breakdown facilitates identifying potential cost-saving measures and mitigating financial risks associated with long-term commitments.

Tax Implications to Consider

Understanding the tax implications of any financial decision is crucial. Whether you’re investing, selling property, or starting a business, taxes play a significant role in your overall financial outcome. Failing to consider these implications can lead to unexpected expenses and potentially reduce your profits. Therefore, it is highly recommended to consult with a tax professional to ensure you’re making informed decisions.

Different types of investments and income streams are taxed differently. For example, capital gains from selling stocks may be subject to different tax rates than income earned from a salary. Additionally, certain tax-advantaged accounts, like retirement accounts, can offer significant benefits by reducing your current tax burden. Knowing these distinctions is essential for maximizing your after-tax returns.

Tax laws are complex and constantly evolving. Staying updated on current regulations and seeking professional advice can help you navigate the complexities and potentially minimize your tax liability. By proactively addressing the tax implications of your financial decisions, you can better manage your finances and achieve your financial goals.

Mileage Limits and Wear-and-Tear Fees

Mileage limits restrict the total miles you can drive a leased vehicle during the lease term. Exceeding this limit results in excess mileage fees, typically charged per mile over the allowed amount. These fees are outlined in your lease agreement and vary depending on the leasing company and specific vehicle. It’s crucial to accurately estimate your annual mileage needs before signing a lease to avoid unexpected costs at the end of your lease term.

Wear-and-tear fees cover damage to the vehicle beyond what’s considered normal wear and tear for the duration of the lease. This can include excessive scratches, dents, dings, interior stains, or mechanical issues. Lease agreements generally provide guidelines for acceptable wear and tear, and exceeding these guidelines can result in fees at lease-end. Maintaining the vehicle’s condition and addressing any minor damage promptly can help minimize these charges.

Understanding both mileage limits and wear-and-tear guidelines is essential when considering a lease. Carefully review your lease agreement, paying close attention to the specific allowances and associated fees. Being aware of these conditions from the outset can help you avoid costly surprises and ensure a smooth lease return process.

How Your Credit Affects Options

Your credit score plays a significant role in your ability to trade options. Brokerages assess your creditworthiness to determine your suitability for options trading. A higher credit score generally suggests responsible financial behavior, increasing your likelihood of approval for higher options trading levels. Conversely, a lower credit score may limit your access to certain options strategies or even prevent you from trading options altogether. Brokerages want to minimize their risk, and a poor credit history may signal a higher risk of default.

While a good credit score is important for accessing higher options trading levels, it doesn’t guarantee success. Options trading involves inherent risks, and even experienced traders can lose money. Your credit score is simply one factor brokerages consider when determining your eligibility. They also look at factors such as your investment experience, income, and net worth.

If you’re interested in trading options, it’s important to understand how your credit can affect your access. Checking your credit report regularly and taking steps to improve your score can increase your chances of being approved for the options trading strategies you want to pursue. Keep in mind that responsible financial habits, reflected in a good credit score, benefit you in multiple aspects of your financial life.

Which Option Matches Your Lifestyle?

Choosing the right product depends on a variety of factors. Consider your day-to-day needs. Do you need something portable and lightweight? Or is durability and long-term performance more important? Think about how often you’ll use the product and in what environment. Honest answers to these questions will guide you to the best choice.

Evaluate the features of each option. Some may offer advanced functionalities while others focus on simplicity and ease of use. Consider the learning curve involved. If you need something immediately accessible, a simpler option might be better. If you’re willing to invest time in mastering a product with more capabilities, a more complex option might be preferable. Ultimately, the best option is the one that best aligns with your individual requirements.

Finally, think about your budget. Price can be a significant factor, but remember to weigh it against the value you’re getting. Sometimes, investing a little more upfront can save you money in the long run. Compare the cost of each option with its expected lifespan and potential maintenance expenses. This will help you make a well-informed and financially sound decision.