In today’s economic climate, maximizing your savings is more crucial than ever. A high-yield savings account offers a powerful tool to combat inflation and grow your wealth steadily. Choosing the best high-yield savings account can be the difference between earning minimal interest and seeing your money flourish. This article will provide you with the essential knowledge to navigate the landscape of high-yield savings accounts and identify the perfect one to meet your financial goals. We’ll cover key factors to consider, such as interest rates, fees, account minimums, and online accessibility. Learn how to make an informed decision and unlock the full potential of your savings.

Finding the best high-yield savings account requires careful consideration of various factors. Don’t settle for a mediocre return on your hard-earned money. This guide will empower you to compare and contrast high-yield savings accounts offered by different financial institutions. We’ll delve into the nuances of APY (Annual Percentage Yield) and how it impacts your earnings. By understanding the key features and benefits of high-yield savings accounts, you’ll be well-equipped to make a smart financial decision that aligns with your short-term and long-term savings objectives.

What Is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers a higher interest rate compared to traditional savings accounts. This means your deposited funds grow at a faster pace, allowing you to earn more money on your savings. These accounts are typically offered by online banks or credit unions, which often have lower overhead costs than traditional brick-and-mortar institutions, allowing them to pass the savings on to customers in the form of higher interest rates.

While the specific interest rate offered can vary, high-yield savings accounts generally offer significantly more interest than standard savings accounts. This makes them a good option for individuals looking to maximize their savings growth while maintaining easy access to their funds. It’s important to note that while these accounts offer competitive interest rates, they are still considered low-risk investments, and the principal balance is typically FDIC insured up to $250,000 per depositor, per insured bank.

Choosing a high-yield savings account often involves comparing interest rates, fees, and account features across different financial institutions. Some factors to consider include minimum balance requirements, monthly fees, and the availability of online and mobile banking tools. By carefully comparing these factors, you can select an account that best aligns with your financial goals and needs.

Why Interest Rates Matter

Interest rates are a fundamental component of any economy. They represent the cost of borrowing money and the return on savings. Changes in interest rates influence a wide range of economic decisions, from consumer spending and business investment to government borrowing and currency exchange rates. When interest rates are low, borrowing becomes cheaper, encouraging spending and investment. Conversely, high interest rates increase the cost of borrowing, potentially slowing economic growth.

Central banks play a critical role in managing interest rates to achieve specific economic objectives, primarily controlling inflation and promoting sustainable economic growth. By adjusting interest rates, central banks attempt to influence the level of economic activity. For example, to combat inflation, central banks may increase interest rates to discourage borrowing and spending, thereby reducing demand and slowing price increases.

Interest rates also have a direct impact on individuals. They influence the cost of mortgages, auto loans, credit card debt, and student loans. Higher interest rates mean higher monthly payments for borrowers, while lower rates can make borrowing more affordable. Similarly, savers benefit from higher interest rates as they earn greater returns on their deposits.

Comparing Online vs. Traditional Banks

Traditional banks offer a wide range of services from checking and savings accounts to loans and investment products. They operate through a network of physical branches, providing in-person customer service. This allows for face-to-face interaction which can be beneficial for complex transactions or personalized financial advice. However, traditional banks often have higher overhead costs which can result in higher fees and lower interest rates on savings accounts compared to online banks. Their hours of operation are also typically limited to standard business hours.

Online banks primarily operate digitally, offering services through websites and mobile apps. This digital focus typically leads to lower operating costs, allowing them to offer more competitive interest rates on savings accounts and lower fees. Customers can access their accounts and manage finances 24/7, offering greater convenience and flexibility. However, the lack of physical branches can be a drawback for customers who prefer in-person interactions, particularly for complex transactions or needing personalized financial advice. Depositing cash can also be more challenging with online banks.

Ultimately, the best choice depends on individual needs and preferences. Those who prioritize convenient account access, lower fees, and higher interest rates might favor online banks. Customers who value in-person service and readily available physical branches might prefer traditional banking.

Fees and Minimum Balance Requirements

We strive to offer transparent and competitive pricing. Our monthly maintenance fee is currently waived for all new accounts opened within the promotional period. After this period, the standard monthly fee of $10 will apply unless you maintain a minimum daily balance of $1,000. A $35 overdraft fee will be charged for each transaction that overdraws your account, up to a maximum of four overdraft fees per day.

Other fees may apply for specific services. These include, but are not limited to: a $3 domestic ATM withdrawal fee (plus any fees charged by the ATM owner), a $5 international ATM withdrawal fee (plus any fees charged by the ATM owner), and a $25 wire transfer fee. For a complete fee schedule, please refer to our separate disclosure document.

Maintaining the minimum balance requirement allows you to avoid the monthly maintenance fee and enjoy the full benefits of your account. We encourage you to review your account activity regularly to ensure you maintain the required balance and avoid any unnecessary fees.

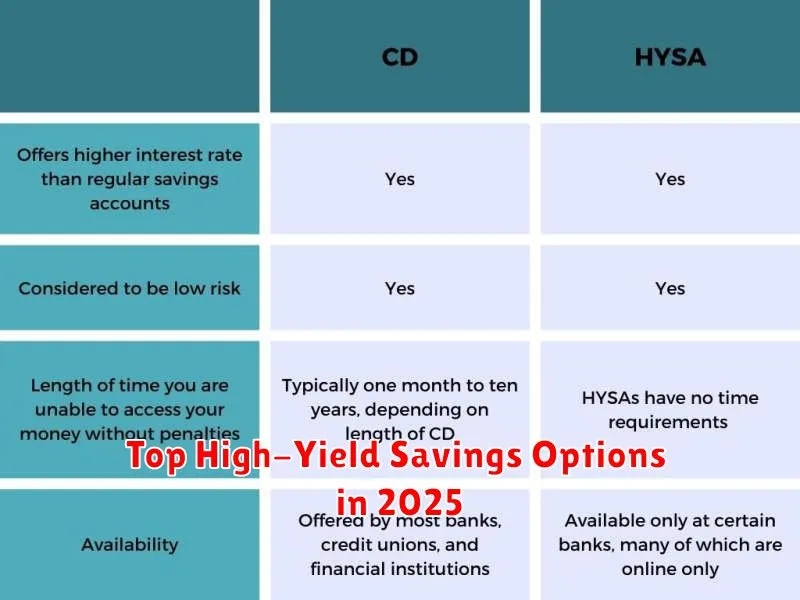

Top High-Yield Savings Options in 2025

In 2025, savers are fortunate to have several high-yield options to choose from. Online savings accounts and money market accounts continue to offer competitive interest rates, often exceeding those found at traditional brick-and-mortar banks. These accounts provide FDIC insurance, ensuring the safety of your deposits up to $250,000 per depositor, per insured bank. When considering these options, pay close attention to any minimum balance requirements or monthly fees that could impact your overall return.

High-yield checking accounts also remain a viable option for those who want easy access to their funds while still earning a decent return. However, these accounts typically come with more stringent requirements, such as a minimum number of debit card transactions or direct deposits per month. Be sure to compare the terms and conditions carefully to ensure they align with your banking habits. In addition to these more common options, consider exploring certificates of deposit (CDs) if you’re comfortable locking in your money for a specified period in exchange for a potentially higher interest rate.

Making the right choice for your savings depends on your individual financial goals and needs. Consider factors such as the frequency of access you require, the level of risk you’re comfortable with, and the overall return you’re aiming for. By carefully researching and comparing the available options, you can find the best high-yield savings solution to help you maximize your financial growth in 2025.

How to Open an Account

Opening an account is typically a straightforward process. First, you’ll need to choose the type of account that best fits your needs. This could be a checking account, savings account, or another type of financial account. Researching different options and comparing features is crucial to finding the right account for you.

Next, you will need to gather the required documentation. This generally includes a valid government-issued photo ID, such as a driver’s license or passport, and proof of address. Some institutions may require additional documentation. Be sure to contact the specific institution where you plan to open the account to confirm their requirements.

Finally, you can begin the application process. This can often be done online, in person at a branch, or sometimes by mail. You’ll need to provide the required information and documentation. Once your application is approved, you’ll receive confirmation and can begin using your new account. Remember to review the terms and conditions associated with your new account.

Tips to Maximize Your Earnings

Maximizing your earnings involves a multi-faceted approach. Identify your current income streams and analyze areas for potential growth. This could involve negotiating a raise at your current job, developing valuable new skills to increase your earning potential, or exploring alternative income opportunities such as freelancing or investing. Budgeting and saving are also crucial components. By carefully tracking your expenses and identifying areas to cut back, you’ll free up more money to invest and grow your wealth.

Investing wisely is a powerful tool for wealth generation. Consider diversifying your investments across various asset classes, such as stocks, bonds, and real estate. It’s important to research different investment options and understand the associated risks before making any decisions. Consulting with a financial advisor can provide personalized guidance based on your individual financial goals and risk tolerance.

Continuously learning and adapting is essential in today’s dynamic economy. Stay updated on industry trends and seek out opportunities to expand your skillset. This can involve taking online courses, attending workshops, or pursuing further education. Networking can also open doors to new career prospects and potential income streams. Building strong relationships with colleagues, mentors, and industry professionals can provide valuable insights and opportunities for growth.

Avoiding Common Pitfalls

One of the most common pitfalls people encounter is a lack of planning. Whether it’s a project, a financial decision, or even a simple task, failing to plan adequately can lead to unnecessary stress and unforeseen complications. Taking the time to think through the steps involved, anticipate potential challenges, and develop contingency plans can significantly improve your chances of success.

Another frequent mistake is poor communication. Clear and concise communication is essential in all aspects of life. Misunderstandings can easily arise from ambiguous language, incomplete information, or a lack of active listening. Prioritize clear communication by choosing your words carefully, ensuring your message is understood, and seeking clarification when needed. This applies to both written and verbal communication.

Finally, procrastination can be a significant stumbling block. Putting things off until the last minute often leads to rushed work, missed deadlines, and increased stress. Developing good time management skills and prioritizing tasks effectively can help overcome this common pitfall. Breaking down large tasks into smaller, manageable chunks can also make them seem less daunting and help maintain momentum.