Managing your finances effectively is crucial in today’s dynamic economic landscape. Budgeting apps offer a powerful solution to track expenses, set financial goals, and achieve financial stability. In 2025, the right budgeting app can be the key to unlocking your financial potential, whether you’re saving for a down payment, paying off debt, or simply aiming for better financial control. Choosing the best budgeting app can be challenging, given the multitude of options available. This article explores the top budgeting apps available in 2025, providing in-depth insights to help you make an informed decision and take charge of your money management.

Navigating the world of personal finance can feel overwhelming. From expense tracking to financial planning, there’s a lot to juggle. That’s why using a top budgeting app is more important than ever. This article will help you discover the best budgeting apps of 2025, breaking down their features, benefits, and pricing to help you choose the perfect fit for your money management needs. Whether you’re a seasoned budgeter or just starting out, finding the right app can make a significant difference in reaching your financial goals.

Why Use a Budgeting App?

In today’s fast-paced world, managing personal finances can be challenging. A budgeting app provides a convenient and efficient way to track income and expenses, offering a clear picture of your financial health. By automating the process, these apps help identify spending patterns, prioritize financial goals, and ultimately gain better control over your money.

Budgeting apps offer a variety of valuable features. They can categorize transactions, create personalized budgets, set financial goals, and send alerts about upcoming bills or potential overspending. Many apps also provide insightful reports and visualizations, allowing you to easily analyze your financial habits and make informed decisions. This level of awareness is crucial for making progress toward financial stability and achieving long-term objectives.

Ultimately, using a budgeting app empowers you to make smarter financial choices. By providing a clear and accessible overview of your finances, these apps make it easier to identify areas for improvement, save effectively, and work toward a more secure financial future. The convenience, insights, and control they offer make them an invaluable tool for anyone seeking to improve their financial well-being.

What Features to Look For

When selecting a product or service, identifying key features is crucial for making an informed decision. Functionality should be a primary consideration. Does the product or service effectively address your specific needs and requirements? Reliability is also essential. Look for a proven track record of consistent performance and durability. Consider factors such as warranties, customer reviews, and expert opinions to assess the product’s or service’s long-term viability.

Usability and convenience are important factors, especially for products or services used frequently. A user-friendly interface, intuitive controls, and readily available support can significantly enhance the overall experience. Evaluate the ease of setup, operation, and maintenance. For services, consider accessibility, responsiveness, and the availability of various communication channels.

Finally, cost-effectiveness plays a vital role. Analyze the price in relation to the features offered, the expected lifespan, and potential long-term costs such as maintenance or subscription fees. Compare similar products or services to determine the best value for your investment. Don’t solely focus on the initial price; consider the overall value proposition and the potential return on investment.

Best Free Options

Choosing the best free option depends heavily on your specific needs and priorities. If cost is your absolute top priority, truly free options are available, but often come with limitations. These might include limited features, advertisements, or usage restrictions. Carefully consider what trade-offs you are willing to make to avoid a monetary cost.

Free tiers of paid services offer another approach. These provide a taste of premium features, often enough for basic use, but restrict access to advanced functionalities or impose usage caps. This can be an excellent way to test a service before committing to a paid subscription, or a viable long-term solution if the free tier meets your needs. Always examine the limitations of the free tier before making your choice.

Finally, consider open-source alternatives. These are often completely free to use, modify, and distribute. While open-source options may require more technical expertise to set up and maintain, they offer unparalleled flexibility and control. Evaluate your technical skills and the community support available for a given open-source option before choosing this route.

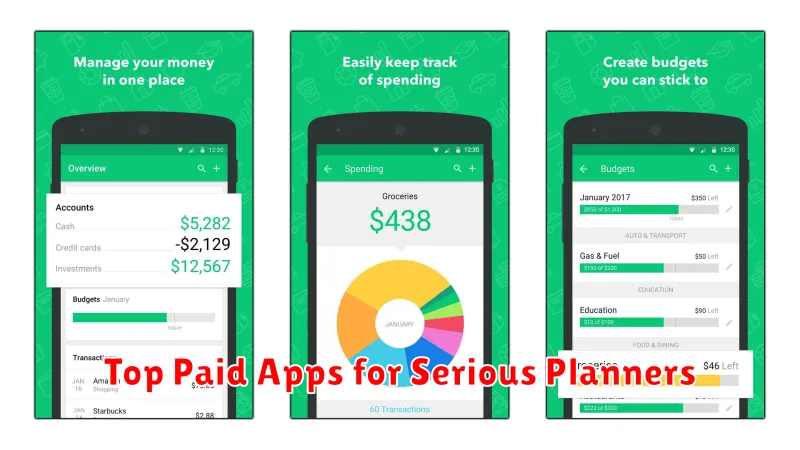

Top Paid Apps for Serious Planners

For those committed to organization and productivity, several premium planning apps stand out. These apps offer advanced features beyond basic calendar and to-do list functionalities, often incorporating project management tools, habit trackers, and customizable views. Investing in a paid app can significantly enhance planning capabilities, providing a centralized platform for managing various aspects of life, from work projects to personal goals.

Some popular choices among serious planners include apps like Things, known for its intuitive interface and task management system, and Fantastical, which boasts natural language processing for effortless event creation and robust calendar integration. Other strong contenders are OmniFocus, a powerful project management tool, and Agenda, a date-focused note-taking app ideal for meeting notes and project timelines. These apps typically offer seamless synchronization across devices, ensuring access to plans and schedules wherever needed.

Choosing the right paid planning app depends on individual needs and preferences. Some users prioritize a minimalist design, while others value comprehensive features. Factors to consider include the level of customization offered, the availability of collaboration features, and the app’s integration with other productivity tools. Evaluating these aspects can help determine which app will best support a streamlined and efficient planning process.

Apps That Sync With Banks

Many financial apps offer the ability to sync directly with your bank accounts. This connection allows the app to automatically import your transaction data, providing a consolidated view of your finances. These apps can categorize spending, track budgets, and even offer investment advice based on your spending habits. It’s important to choose apps from reputable providers and understand their security practices before granting access to your banking information.

Syncing your bank accounts with these apps can offer a range of benefits. They can simplify budgeting, help identify areas for potential savings, and provide a more comprehensive understanding of your overall financial health. Some apps also offer fraud alerts, notifying you of suspicious activity on your accounts. However, it’s crucial to be aware of the potential risks. Ensure the app employs robust security measures, including multi-factor authentication, to protect your sensitive data.

There are various types of apps that sync with banks, catering to different financial needs. Popular categories include budgeting apps, expense trackers, investment platforms, and personal finance management tools. Before selecting an app, consider your specific goals and research the app’s features, fees, and security protocols. Choosing the right app can significantly impact your ability to effectively manage and track your finances.

How to Stay Consistent With Budgeting

Creating a budget is a great first step towards financial stability, but the real key is consistency. Track your spending regularly. Whether you prefer a budgeting app, a spreadsheet, or a simple notebook, consistent tracking is crucial to understanding where your money goes. This awareness allows you to identify areas for improvement and adjust your spending habits accordingly. Set realistic goals for yourself and celebrate small victories along the way to maintain motivation.

Automate your savings whenever possible. Setting up automatic transfers to a savings or investment account each month takes the effort out of saving. Treat these transfers like any other bill and adjust your budget around them. This ensures that you’re consistently saving, even when life gets busy. Choose a savings amount that aligns with your financial goals and income, and gradually increase it over time as your income grows.

Regularly review and adjust your budget. Your financial situation and goals will change over time, so your budget should too. Set aside time each month to review your spending, compare it to your budget, and make adjustments as needed. This will help you stay on track and ensure your budget continues to serve your evolving financial needs. Don’t be afraid to seek professional advice if you’re struggling to manage your finances effectively.

Privacy and Security Considerations

Protecting user privacy and ensuring data security are paramount. Implementing robust security measures, such as encryption and access controls, is crucial to safeguarding sensitive information. Regular security assessments and penetration testing should be conducted to identify and address potential vulnerabilities. Adherence to relevant data privacy regulations, such as GDPR or CCPA, is mandatory and requires careful consideration of data collection, storage, and processing practices.

Transparency with users about data collection and usage practices is essential. A clear and concise privacy policy should outline what data is collected, how it is used, and with whom it is shared. Users should have control over their data and be provided with options to access, modify, and delete their information. Minimizing data collection to only what is necessary for the intended purpose is a key principle of privacy-preserving design.

Security awareness training for personnel is vital to maintaining a strong security posture. Employees should be educated on best practices for password management, phishing prevention, and incident response. Regularly updating software and systems with security patches is crucial to mitigating known vulnerabilities and protecting against emerging threats. A well-defined incident response plan should be in place to effectively manage and contain security breaches should they occur.

Comparing Reviews and Ratings

Reviews provide in-depth, qualitative feedback about a product or service, often including personal experiences and detailed explanations of pros and cons. They offer valuable context and insights that go beyond simple numerical scores. Ratings, on the other hand, offer a quick, quantitative overview through a numerical or star-based system. They are easy to digest and allow for quick comparisons between different options, but lack the detailed feedback found in reviews.

When making a decision, consider both reviews and ratings. Use ratings to quickly narrow down your choices and identify top contenders. Then, dive deeper into the reviews to understand the nuances and specific details behind the scores. Look for recurring themes and sentiments across multiple reviews to gain a more comprehensive understanding of the strengths and weaknesses of each option.

Ultimately, the best approach depends on the complexity of your decision. For simple purchases, ratings might suffice. However, for more significant investments, like choosing a car or a doctor, thoroughly reading reviews is crucial for making an informed choice.