Choosing the right personal loan can be a crucial financial decision. Understanding the various loan options, interest rates, fees, and repayment terms is essential to securing a personal loan that aligns with your financial needs and goals. This guide will walk you through the key factors to consider when comparing personal loans, empowering you to make an informed choice and avoid potential financial pitfalls. Whether you’re consolidating debt, funding a home improvement project, or covering unexpected expenses, finding the right personal loan can make all the difference.

Navigating the personal loan landscape can feel overwhelming, but with careful consideration of your financial situation and the available loan offers, you can confidently select the best personal loan for your individual circumstances. From understanding your credit score to evaluating loan terms and conditions, this article will equip you with the knowledge necessary to make a sound personal loan decision. By carefully analyzing loan offers and focusing on responsible borrowing practices, you can harness the power of a personal loan to achieve your financial objectives.

What Is a Personal Loan?

A personal loan is a fixed-amount loan that you borrow from a financial institution, such as a bank or credit union, and repay over a set period of time with fixed monthly payments. Unlike secured loans, which require collateral like a car or house, personal loans are generally unsecured, meaning they don’t require collateral. This can make them easier to obtain but often results in a higher interest rate. The interest rate and loan terms are determined based on factors such as your credit score, income, and debt-to-income ratio.

Personal loans offer flexibility in how you use the funds. Common uses include debt consolidation, home improvements, medical expenses, and large purchases. Because they are a fixed-term loan, you know exactly how much you need to pay each month and when the loan will be paid off, allowing for better budgeting and financial planning.

Before taking out a personal loan, it’s crucial to compare offers from different lenders, paying close attention to the interest rate, fees, and repayment terms. Borrowing responsibly and ensuring you can comfortably afford the monthly payments will help you avoid potential financial difficulties in the future.

When to Consider a Personal Loan

A personal loan can be a valuable tool for managing finances, but it’s essential to understand when it’s the right choice. Consider a personal loan for debt consolidation. If you’re juggling multiple high-interest debts, a personal loan can streamline payments and potentially lower your overall interest rate. This simplifies your financial obligations and can lead to faster debt payoff. Also, consider a personal loan for necessary home improvements that add value to your property. This could include renovations to kitchens or bathrooms, or essential repairs that improve functionality and energy efficiency. A personal loan can provide the funds needed without requiring you to tap into home equity.

Personal loans can also be a good option for covering major expenses like medical bills or unexpected car repairs. These situations often require immediate access to funds, and a personal loan can offer a quicker solution than other financing options. However, carefully evaluate the interest rate and terms before proceeding. Ensure the loan aligns with your budget and repayment capabilities.

It’s crucial to avoid using personal loans for non-essential expenses, such as vacations or luxury items. These purchases don’t typically increase in value and can lead to unnecessary debt accumulation. Before taking out a personal loan, always create a realistic budget and assess whether the loan aligns with your long-term financial goals. Consider the total cost of the loan, including interest and fees, and ensure you can comfortably afford the monthly payments.

Fixed vs. Variable Rates

When choosing between fixed and variable rates for loans or investments, it’s crucial to understand their core differences. A fixed rate remains constant for the entire term of the loan or investment. This provides predictability and stability, allowing you to budget effectively knowing your payments or returns won’t change. Fixed rates are generally higher initially than variable rates to compensate the lender for the risk of potential future interest rate increases. This option is often preferred by individuals with a lower risk tolerance.

In contrast, a variable rate fluctuates based on market conditions and an underlying benchmark interest rate. This means your payments or returns can increase or decrease over time. While a variable rate may initially be lower than a fixed rate, offering potential savings, it also carries the risk of rising interest rates leading to higher payments in the future. Borrowers or investors comfortable with greater uncertainty and potentially higher returns may opt for a variable rate.

Ultimately, the best choice depends on your individual financial situation, risk tolerance, and the overall economic outlook. Carefully consider your long-term financial goals and the potential impact of interest rate changes before making a decision. Consulting with a financial advisor can provide personalized guidance in assessing which rate option best aligns with your circumstances.

How to Compare Offers from Lenders

Comparing offers from different lenders is crucial to securing the best loan terms. Interest rate is a key factor; a lower rate translates to lower monthly payments and less interest paid over the life of the loan. Carefully examine the annual percentage rate (APR), which includes the interest rate and other fees, providing a more comprehensive view of the loan’s true cost. Also, consider the loan term, as shorter terms typically have higher monthly payments but result in less overall interest paid, while longer terms have lower monthly payments but accrue more interest over time.

Beyond the core financial aspects, evaluate the loan type. Fixed-rate loans offer predictable monthly payments, while adjustable-rate mortgages (ARMs) may start with a lower rate but can fluctuate over time. Assess the fees associated with the loan, including origination fees, appraisal fees, and closing costs. These fees can vary significantly between lenders and can substantially impact the overall cost of the loan. Finally, consider the lender’s reputation and customer service. Research reviews and ratings to ensure you choose a reputable lender with a history of positive customer experiences.

In summary, comparing offers requires diligent research and attention to detail. Focus on the APR, loan term, fees, and loan type to make an informed decision. Choose the loan that best aligns with your individual financial situation and goals.

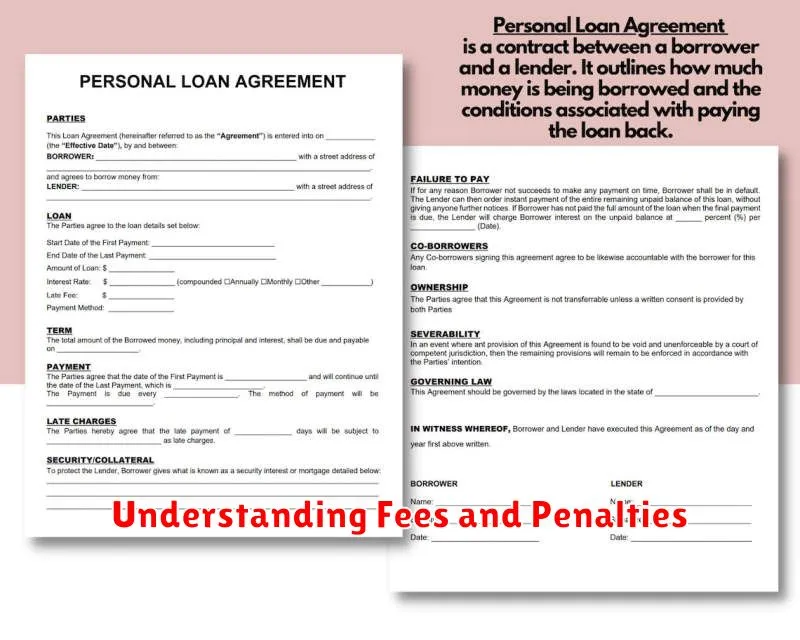

Understanding Fees and Penalties

Fees are typically charges for services rendered or goods provided. They are often predictable and disclosed upfront. Think of application fees, subscription fees, or processing fees. These costs are generally associated with a specific transaction or service and are not punitive in nature. Understanding fees upfront helps you budget and avoid unexpected costs.

Penalties, on the other hand, are consequences for violating a rule, agreement, or law. They are designed to discourage undesirable behavior and often involve financial repercussions. Examples include late payment penalties, early withdrawal penalties, or legal penalties. Penalties are typically not anticipated, but knowing the potential consequences of specific actions can help you avoid them.

The key difference lies in the purpose of the charge. Fees are the cost of doing business, while penalties are the cost of not following the rules. Recognizing this distinction allows for better financial planning and decision-making.

Online vs Traditional Banks

Online banks operate primarily, or exclusively, on the internet. They generally offer higher interest rates on savings accounts and lower fees compared to traditional banks. This is because they have lower overhead costs without physical branches. However, they may lack some services like in-person teller assistance, and depositing cash can sometimes be less convenient. Some online banks offer partner ATM networks for cash deposits and withdrawals.

Traditional banks have physical branches where you can conduct transactions face-to-face with a teller. This offers a more personalized experience for those who prefer it. They offer a wider range of services, such as safe deposit boxes, notary services, and wealth management advice. Traditional banks may have more fees and lower interest rates on savings accounts due to the cost of maintaining physical branches.

Choosing between an online and a traditional bank depends on your individual needs. Consider factors such as your comfort level with technology, the importance of in-person banking services, fees, and interest rates. If you are comfortable managing your finances online and prioritize higher interest rates and lower fees, an online bank may be a good choice. If you value personalized service and access to a wider range of services, a traditional bank might be a better fit.

Credit Requirements to Qualify

Lenders assess several factors when you apply for credit, including your credit score, credit history, and debt-to-income ratio. A good credit score is generally considered essential for qualifying for most loans and credit cards. Lenders use your score to predict how likely you are to repay borrowed money. Credit history reveals your past borrowing behavior, including payment history and outstanding debts. Finally, your debt-to-income ratio (DTI) compares your monthly debt payments to your gross monthly income and indicates your ability to manage additional debt.

While minimum credit score requirements vary by lender and product, a higher score typically unlocks better interest rates and terms. For example, a borrower with a credit score above 750 might qualify for a lower interest rate on a mortgage than someone with a score of 650. A longer and positive credit history also strengthens your application. Lenders prefer to see consistent on-time payments and a manageable level of debt. A low DTI demonstrates responsible financial management and improves your chances of approval.

If your credit score is less than ideal, there are steps you can take to improve it. Paying bills on time, reducing outstanding debt, and limiting new credit applications can all positively impact your score over time. Building a positive credit history takes time and effort, but it’s crucial for accessing financial products and services at favorable terms.

Tips Before Applying

Before submitting your application, take the time to carefully review the job description and requirements. Ensure your skills and experience align with what the employer is seeking. Tailor your resume and cover letter to specifically address the key qualifications and highlight your relevant accomplishments. This demonstrates your genuine interest and increases your chances of being selected for an interview.

Research the company thoroughly. Understanding their mission, values, and culture will allow you to articulate why you are a good fit for their organization. This preparation will also be valuable during the interview process. Look into the company’s recent news and industry trends to demonstrate your proactive approach and knowledge of the field.

Finally, proofread everything! Ensure your application materials are free of typos, grammatical errors, and formatting inconsistencies. A polished and professional application reflects positively on your attention to detail and overall candidacy. Consider having a friend or mentor review your documents for a fresh perspective.