Unlock the power of compound interest and watch your money grow exponentially. This beginner’s guide will demystify the concept of compound interest, explaining how it works and why it’s crucial for building long-term wealth. Whether you’re saving for retirement, a down payment on a house, or simply seeking financial security, understanding compound interest is a fundamental step towards achieving your financial goals. Learn how to calculate compound interest, discover the factors that influence its growth, and explore practical strategies to harness its power. Prepare to be amazed by the potential of compound interest to transform your finances.

Embark on your journey to financial freedom by mastering the magic of compound interest. This comprehensive guide will equip you with the knowledge and tools you need to effectively leverage compound interest. We’ll cover key concepts such as principal, interest rate, compounding periods, and the rule of 72. By understanding these elements, you’ll gain a clearer understanding of how to maximize your returns and accelerate your wealth-building journey. Discover how small, consistent investments coupled with the power of compound interest can lead to significant financial gains over time.

What Is Compound Interest?

Compound interest is the interest you earn on your principal plus any accumulated interest. In essence, it’s “interest on interest,” which makes a sum grow at a faster rate than simple interest. This occurs because interest earned is added back to the principal sum and the next interest calculation is based on the larger amount. Over time, this compounding effect can lead to significant growth.

To illustrate, imagine you invest $1,000 at a 10% annual interest rate compounded annually. After one year, you earn $100 in interest, making your new balance $1,100. In the second year, you earn 10% not just on the original $1,000, but on the $1,100, resulting in $110 of interest earned. The key takeaway is that the growth accelerates over time as the interest earns more interest.

The frequency of compounding (e.g., daily, monthly, annually) influences how quickly your investment grows. More frequent compounding leads to faster growth. Several factors affect the growth of an investment with compound interest, including the initial principal, the interest rate, and the time period the money is invested. The longer your money is invested, and the higher the interest rate, the greater the benefit from compounding.

How It Differs From Simple Interest

The primary difference between compound interest and simple interest lies in how the interest is calculated. Simple interest is calculated only on the principal amount. For example, if you invest $1,000 at a 5% annual simple interest rate, you will earn $50 each year, regardless of how long you keep the money invested. Compound interest, on the other hand, is calculated on the principal plus any accumulated interest. This means your interest earns interest, leading to exponential growth over time.

This difference in calculation creates a significant divergence in returns, especially over longer periods. While simple interest yields a constant return, the returns from compound interest accelerate over time. The longer the money is invested, the larger the difference becomes between the returns generated by these two interest methods. This “snowball effect” is the reason why compounding is often referred to as the eighth wonder of the world.

To illustrate, consider a $1,000 investment over 10 years at a 5% annual rate. With simple interest, you earn $50 annually for a total of $500 in interest. With compound interest, your return will be higher because each year’s earned interest is added to the principal, generating even more interest the following year. This difference becomes dramatically more pronounced over longer time horizons.

The Magic of Time in Compounding

Compounding is the process where an asset’s earnings are reinvested to generate additional earnings over time. This creates a snowball effect, where the initial investment grows exponentially. The longer the time horizon, the more significant the impact of compounding, turning small initial investments into substantial sums. This is why time is considered the most critical factor in compounding.

Understanding the power of time requires patience and discipline. It’s not about chasing quick returns, but rather allowing investments to grow steadily over the long term. The impact is particularly noticeable with assets that generate consistent returns, such as dividend-paying stocks or interest-bearing bonds. Delaying investment or withdrawing earnings early can significantly hinder the benefits of compounding.

To maximize the magic of compounding, investors should focus on three key elements: consistent investing, minimizing fees, and patience. Regular contributions, even small ones, coupled with low-cost investments allow more capital to work and compound over time. Avoiding impulsive withdrawals allows the full potential of compounding to unfold, generating significant wealth over the long run.

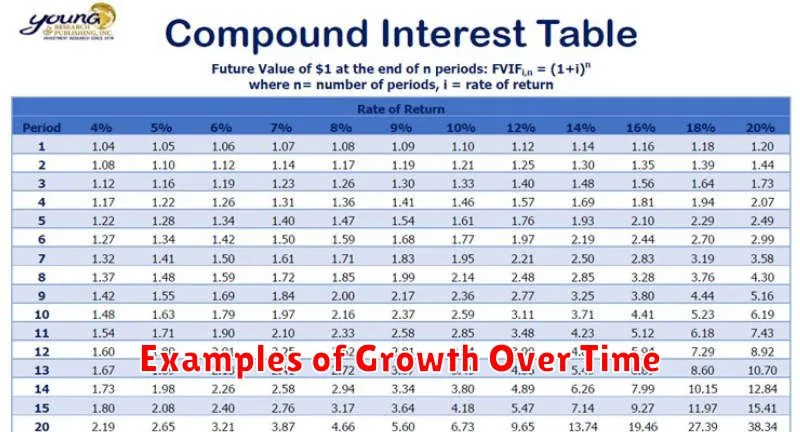

Examples of Growth Over Time

Growth over time is a fundamental concept observed in various aspects of the world, from natural phenomena to human endeavors. Biological growth provides a clear example, with organisms increasing in size and complexity from infancy to maturity. Consider a seedling developing into a towering tree or a human child growing into an adult. This growth, driven by biological processes, is a visible manifestation of change over time.

Economic growth represents another key example. A country’s Gross Domestic Product (GDP), reflecting the total value of goods and services produced, ideally increases over time, indicating a strengthening economy. This can be driven by factors like technological advancements, increased productivity, and expanding markets. Similarly, investment growth showcases the power of compounding. A small initial investment, through accruing interest or returns, can grow significantly over decades, demonstrating the importance of a long-term perspective.

Beyond these examples, growth can be seen in areas like knowledge acquisition, where continuous learning and experience lead to an expanding understanding of the world. Skill development also embodies growth, as consistent practice and training lead to improved proficiency in a particular area. Even population growth, though complex and influenced by numerous factors, represents a form of growth over time.

Where to Find Compound Interest Accounts

Compound interest accounts are offered by a variety of financial institutions, making it relatively easy to find one that suits your needs. Banks and credit unions are common places to find these accounts, typically in the form of savings accounts, money market accounts, and certificates of deposit (CDs). Online banks often offer higher interest rates compared to traditional brick-and-mortar institutions. When considering where to open an account, be sure to compare interest rates, fees, and account minimums.

Beyond traditional banking institutions, you can also find compound interest through investment accounts. These include brokerage accounts that allow you to invest in stocks, bonds, and mutual funds. While these investments offer the potential for higher returns, they also carry a greater degree of risk. It’s important to understand the risks involved before investing and consider your investment goals and time horizon.

Finally, some retirement accounts, such as 401(k)s and IRAs, also offer the benefits of compound interest. These accounts are specifically designed for long-term savings and offer tax advantages that can boost your overall returns. Consult with a financial advisor to determine the best retirement savings strategy for your individual circumstances.

How to Maximize Its Effect

Maximizing the effect of anything requires careful consideration of several factors. First, clearly define your objective. What are you trying to achieve? A specific and measurable goal is crucial. Then, identify the key elements that influence the outcome. Understanding these drivers will allow you to focus your efforts where they will have the greatest impact. Finally, consistent application is key. Sporadic attempts rarely yield significant results.

Next, consider the context. The same actions may produce different results in different situations. Analyze the environment and tailor your approach accordingly. Careful planning and execution are essential. A well-defined strategy will improve your chances of success. Furthermore, regular evaluation and adjustment are vital. Monitor progress and make necessary changes to optimize your efforts.

Lastly, remember the importance of patience and persistence. Meaningful change often takes time and effort. Don’t be discouraged by initial setbacks. Learn from mistakes and stay focused on your objective. By combining these strategies, you can significantly increase the likelihood of maximizing the effect of your endeavors.

Common Mistakes to Avoid

One common mistake people make is failing to plan adequately. Whether it’s a project, a trip, or even a simple meal, lack of planning often leads to inefficiency, stress, and unwanted outcomes. Taking the time to carefully consider your goals, resources, and potential challenges will significantly increase your chances of success.

Another frequent error is poor communication. This can manifest in various ways, from unclear instructions to failing to actively listen. Misunderstandings and conflicts can easily arise when communication is ineffective. Strive for clarity and conciseness in your message, and always confirm understanding with the recipient.

Finally, many individuals neglect the importance of self-care. Prioritizing your physical and mental well-being is essential for maintaining productivity and overall happiness. This includes getting enough sleep, eating nutritious food, exercising regularly, and taking breaks when needed. Ignoring these needs can lead to burnout, decreased performance, and even health problems.

Start Small, Think Big

Starting small is a powerful strategy for achieving big goals. It allows you to build momentum, gain experience, and refine your approach without feeling overwhelmed. By focusing on manageable steps, you develop confidence and consistency, which are crucial for long-term success. Whether you’re launching a business, learning a new skill, or adopting a healthier lifestyle, starting small provides a solid foundation.

Thinking big, on the other hand, provides direction and motivation. It fuels your efforts and helps you stay focused on the ultimate objective. Having a clear vision of your desired outcome allows you to make informed decisions and prioritize tasks effectively. While starting small is essential for practical execution, thinking big ensures that your efforts contribute to a larger, more meaningful purpose.

The combination of starting small and thinking big is a winning formula. It fosters a growth mindset by encouraging experimentation and continuous improvement. By embracing this approach, you can transform ambitious dreams into tangible realities.