Setting realistic financial goals is crucial for achieving financial stability and success. Whether you’re aiming to pay off debt, save for a down payment, or build a robust retirement fund, setting achievable milestones is the first step. This article will provide a practical guide to establishing financial goals that align with your individual circumstances and resources, helping you to create a financial plan you can actually stick to throughout the year. We’ll explore the importance of budgeting, saving, and investing as integral components of a successful financial strategy. Learn how to avoid common pitfalls and stay motivated on your journey toward financial well-being by setting realistic financial goals for the year.

Many individuals start the year with ambitious financial goals, only to find themselves discouraged and off track within a few months. This is often due to setting unrealistic expectations that don’t consider their current financial situation. By understanding your income, expenses, and debts, you can create a realistic budget and set achievable financial goals for the year. This article will guide you through a step-by-step process, offering practical tips and strategies to define, prioritize, and achieve your financial goals. Discover how to break down large objectives into smaller, manageable steps, making the process less daunting and more rewarding. Start your journey towards financial success by learning how to set realistic financial goals today.

Why Financial Goals Matter

Financial goals provide direction and purpose to your financial decisions. Without clear objectives, it’s easy to overspend, accumulate unnecessary debt, and ultimately fall short of achieving your desired financial well-being. Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals allows you to track progress, stay motivated, and make informed choices about saving, investing, and spending. Whether it’s buying a home, retiring comfortably, or funding your children’s education, having clearly defined financial goals is essential for creating a secure and prosperous future.

Setting financial goals helps you prioritize your spending and saving habits. By identifying what truly matters to you, you can allocate resources effectively and make conscious decisions about where your money goes. This process often involves making trade-offs and delaying gratification in the short-term to achieve larger, long-term objectives. For example, consistently saving a portion of each paycheck toward a down payment on a house might mean forgoing some discretionary spending, but the eventual reward of homeownership makes the sacrifice worthwhile.

Furthermore, establishing financial goals allows you to measure your progress and make adjustments as needed. Regularly reviewing your goals and assessing your financial situation helps you stay on track and adapt to changing circumstances. Life throws curveballs, and your financial goals may need to evolve over time. By actively monitoring your progress, you can identify potential roadblocks, modify your strategies, and ensure you remain focused on achieving your desired financial outcomes.

Short-Term vs Long-Term Goals

Short-term goals are objectives you aim to achieve in the near future, typically within a year or less. These goals serve as stepping stones toward larger aspirations and often involve specific, measurable actions. Examples include completing a project, learning a new skill, or saving a certain amount of money. Focusing on short-term goals allows for consistent progress and builds momentum towards achieving long-term objectives. They provide a sense of accomplishment and motivation, contributing to overall success.

Long-term goals, on the other hand, represent broader ambitions that you envision for your future, usually taking several years or even a lifetime to realize. These goals define your overall direction and purpose. Examples include earning a degree, starting a business, or buying a house. While they might seem distant, long-term goals provide a framework for setting short-term goals, ensuring that your daily actions align with your ultimate vision. It’s important to regularly re-evaluate and adjust long-term goals as circumstances and priorities evolve.

Effectively balancing both short-term and long-term goals is essential for personal and professional growth. Short-term goals provide the immediate motivation and tangible progress needed to stay engaged, while long-term goals provide the overarching direction and purpose. By understanding the interplay between these two types of goals and aligning them strategically, you can create a roadmap for achieving your aspirations and living a fulfilling life.

How to Set SMART Goals

Setting SMART goals is a proven method for achieving success. The SMART acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Each element is crucial for creating a goal that is well-defined and attainable. A specific goal clearly defines what you want to accomplish, avoiding vague language. Measurable goals have concrete criteria for tracking progress and determining success. Achievable goals are realistic and within your capabilities, given available resources and constraints. Relevant goals align with your overall objectives and contribute to your larger purpose. Time-bound goals have a deadline, creating a sense of urgency and accountability.

To apply the SMART framework, begin by stating your goal with precision. For example, instead of “improve fitness,” a specific goal would be “run a 5k in under 30 minutes.” Next, define how you will measure progress, such as tracking weekly running times. Assess whether the goal is achievable based on your current fitness level and available training time. Consider the relevance of the goal to your overall health and well-being. Finally, set a deadline, such as participating in a specific 5k race three months from now.

By adhering to the SMART criteria, you transform vague aspirations into actionable steps. This process promotes clarity, focus, and motivation, ultimately increasing your likelihood of achieving desired outcomes. Whether your goals relate to personal development, career advancement, or any other area of your life, the SMART framework provides a powerful tool for turning ambition into reality.

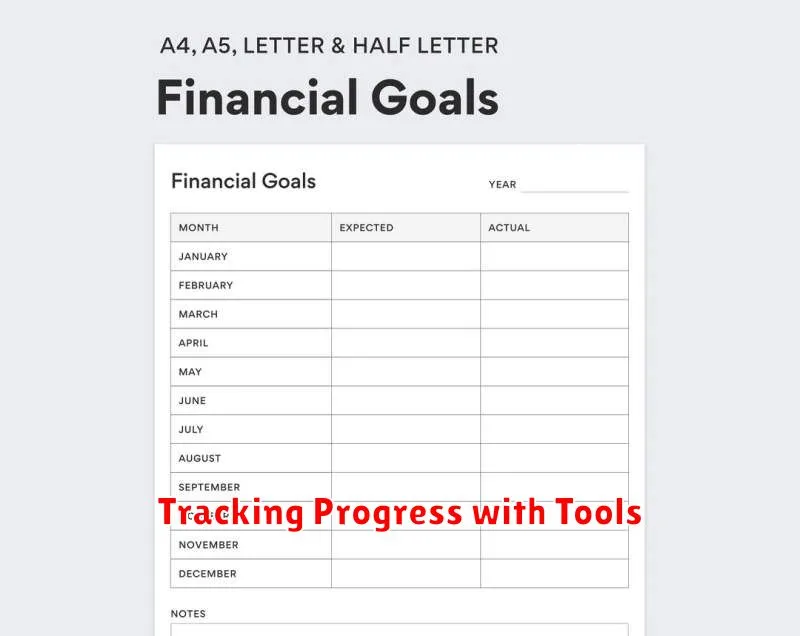

Tracking Progress with Tools

Effective progress tracking is crucial for achieving goals, whether personal or professional. Utilizing the right tools can significantly enhance this process. These tools allow for clear visualization of milestones, identification of potential roadblocks, and ultimately, better management of time and resources.

Various tools are available, ranging from simple spreadsheets to sophisticated project management software. Choosing the right tool depends on the complexity of the project and individual preferences. Simple projects might benefit from basic checklists or task management apps, while complex projects often require dedicated software with features like Gantt charts, dependency tracking, and collaboration capabilities. Consistent use of the chosen tool is key for realizing its full potential.

By integrating progress tracking tools into workflows, individuals and teams can foster accountability, maintain focus, and celebrate achievements along the way. This contributes to increased productivity, improved project outcomes, and a greater sense of accomplishment.

Building Habits Around Money

Building strong financial habits is crucial for long-term stability and success. Start by tracking your spending. Understanding where your money goes is the first step towards taking control of your finances. This can be done through budgeting apps, spreadsheets, or even a simple notebook. Once you have a grasp on your spending patterns, you can identify areas where you can reduce unnecessary expenses and allocate funds towards your financial goals, whether it’s saving for a down payment, paying off debt, or investing for the future.

Automating your finances is a highly effective strategy for building positive money habits. Set up automatic transfers to your savings and investment accounts each month. This “pay yourself first” approach ensures that you consistently contribute to your financial goals before you’re tempted to spend the money elsewhere. Automating bill payments can also prevent late fees and help you maintain a good credit score.

Finally, regularly reviewing your financial progress is essential. Set aside time each month to check your budget, track your net worth, and assess your progress toward your goals. This allows you to make adjustments as needed and stay motivated on your financial journey. This consistent review helps reinforce positive habits and keeps you accountable.

Reevaluating Mid-Year

Mid-year presents a critical opportunity to pause and reflect on the progress made towards established goals. It’s a time to honestly assess what’s working, what isn’t, and where adjustments are needed. Whether personal or professional objectives, this checkpoint allows for course correction and renewed focus for the remainder of the year. Take stock of accomplishments, identify roadblocks, and reaffirm your commitment to achieving desired outcomes.

Re-evaluation shouldn’t just focus on the “what” but also the “how.” Consider if current strategies are effective or if alternative approaches are necessary. This might involve seeking feedback, acquiring new skills, or simply reprioritizing tasks. Being adaptable and willing to adjust plans is essential for maximizing potential and achieving success in the long run.

Ultimately, mid-year reevaluation is about proactive planning and setting yourself up for a stronger finish. It’s a chance to learn from past experiences, refine your approach, and move forward with intention and purpose. Don’t let this valuable opportunity pass by without taking the time to assess, adjust, and reaffirm your commitment to achieving your goals.

Involving Family in Goal-Setting

Setting goals as a family can create a stronger bond and a sense of shared purpose. It encourages open communication and helps everyone feel valued and heard. When families work together towards a common goal, they learn to support each other, celebrate successes, and navigate challenges as a team. This collaborative approach also teaches valuable life skills like planning, commitment, and problem-solving.

Start by having a family meeting to discuss potential goals. Brainstorm ideas together, ensuring everyone gets a chance to contribute. Focus on goals that are realistic, measurable, and meaningful to everyone involved. Examples might include saving for a family vacation, improving family fitness, or dedicating time for regular family meals. Once a goal is chosen, break it down into smaller, achievable steps. Assign roles and responsibilities to each family member, making sure everyone feels empowered to contribute.

Regularly check in on progress and celebrate milestones along the way. Acknowledge individual and collective efforts. If the goal proves too challenging or circumstances change, be flexible and adjust the plan as needed. Remember, the process of working together is just as important as achieving the goal itself. Family goal-setting builds valuable relationships, strengthens communication, and fosters a sense of unity.

Celebrating Financial Milestones

Reaching financial milestones is a significant achievement, deserving of recognition and celebration. Whether it’s paying off debt, reaching a savings goal, or making a smart investment, acknowledging these accomplishments reinforces positive financial habits and motivates you to continue striving for future goals. These milestones can range from small wins, like setting up an emergency fund, to larger ones like purchasing a home. Each step forward, regardless of size, contributes to your overall financial well-being and deserves to be celebrated.

Celebrating these milestones doesn’t have to involve extravagant spending. The focus should be on acknowledging your hard work and dedication. Simple acts like enjoying a special meal, taking a day trip, or purchasing a small item you’ve been wanting can serve as effective rewards. The key is to choose something meaningful and enjoyable that reinforces your commitment to healthy financial practices without jeopardizing your progress. Reflect on the steps you took to achieve the milestone and consider how you can apply those lessons to future goals.

Ultimately, celebrating financial milestones provides a sense of accomplishment and motivation. It reinforces the positive behaviors that led to success and encourages you to continue building a strong financial foundation. This positive reinforcement cycle helps build momentum and creates a sense of pride in your achievements. Remember, every step forward is a victory worth celebrating.