Understanding your credit score is crucial for navigating the financial world. A good credit score unlocks lower interest rates on loans, better credit card offers, and even influences rental applications. This comprehensive guide will delve into the intricacies of credit scores, explaining how they are calculated, what factors impact them, and most importantly, how to improve your credit score. Whether you’re starting from scratch or aiming to reach an exceptional rating, we’ll provide actionable strategies to help you achieve your credit goals.

This article will cover the different credit bureaus, the various credit scoring models, and the range of credit score factors that contribute to your overall rating. You’ll learn about the significance of payment history, amounts owed, length of credit history, new credit, and credit mix. By understanding these key components, you’ll be empowered to take control of your financial well-being and improve your credit health. Learn how to dispute errors on your credit report and develop healthy credit habits for long-term financial success.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. Lenders use credit scores to assess the risk of lending you money. A higher score indicates lower risk for lenders, making it easier to qualify for loans, credit cards, and other forms of credit. Conversely, a lower score suggests higher risk, potentially leading to higher interest rates or even loan denial.

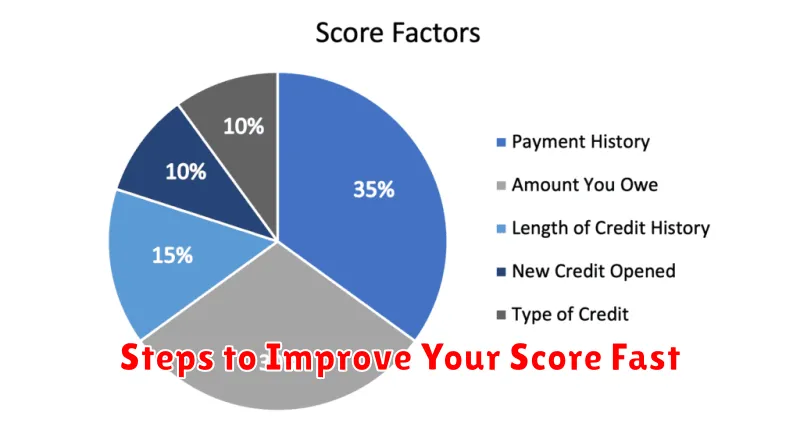

Several factors influence your credit score. Payment history, representing whether you’ve paid past debts on time, is the most significant. Other important factors include amounts owed (your credit utilization), length of credit history, credit mix (different types of credit accounts), and new credit (recent credit applications). Understanding these factors can help you build and maintain a good credit score.

Credit scores range from 300 to 850, with scores above 700 generally considered good. Regularly checking your credit report and disputing any errors is crucial for maintaining accuracy and identifying potential issues. By managing your credit responsibly and understanding the factors that affect your score, you can improve your creditworthiness and access better financial opportunities.

Why Credit Scores Matter

Your credit score is a numerical representation of your creditworthiness, summarizing your history of borrowing and repaying debt. Lenders use this score to assess the risk of lending you money. A higher score signifies a lower risk, suggesting you’re more likely to repay loans on time. This translates to better loan terms, including lower interest rates, higher credit limits, and easier approval for credit cards, mortgages, auto loans, and even some rentals and utilities.

A poor credit score, on the other hand, can significantly impact your financial life. It can lead to higher interest rates, making borrowing more expensive, or even result in loan applications being denied. Furthermore, certain employers and insurance companies consider credit scores when making hiring or underwriting decisions, potentially affecting your job prospects and insurance premiums. Building and maintaining a good credit score is therefore essential for long-term financial health.

Key factors influencing your credit score include payment history, amounts owed, length of credit history, credit mix, and new credit. Focusing on consistent on-time payments, keeping credit utilization low, and avoiding opening too many new accounts simultaneously are crucial steps towards improving and maintaining a healthy credit score.

Main Factors That Affect Your Score

Several key elements contribute to your overall score. Accuracy plays a vital role, encompassing the correctness and precision of your responses. Additionally, completeness is crucial, ensuring that all required components are addressed and no significant details are omitted. Finally, the clarity of your work contributes significantly, ensuring your responses are easily understood and well-organized.

Beyond these core factors, specific criteria may apply depending on the context of the evaluation. For instance, in academic settings, originality and proper citation practices are often emphasized. In professional evaluations, factors like efficiency and collaboration might be considered. The relative importance of these factors can vary depending on the specific assessment.

Understanding these factors allows you to strategically approach tasks and optimize your performance. By focusing on accuracy, completeness, and clarity, you establish a strong foundation. Further tailoring your approach to address context-specific criteria will maximize your potential for a high score.

How to Check Your Score for Free

Checking your credit score is crucial for understanding your financial health. Fortunately, numerous resources allow you to access your score without cost. Many credit card companies and financial institutions provide free access to your credit score directly through their online platforms or mobile apps. Federally mandated annual credit reports are available for free, but these typically do not include your actual credit score. You can access your free annual credit report at AnnualCreditReport.com.

Several reputable websites and apps offer free credit score access along with additional financial tools and resources. These platforms may use different scoring models (like VantageScore or a specific version of FICO) than lenders use, so the scores provided might not be exactly what a lender sees. However, they still provide a valuable snapshot of your overall credit health and can help you track changes over time. It’s important to be aware of potential upsells or promotional offers when using these free services.

Protecting your identity is paramount when checking your credit score online. Always ensure you’re using legitimate and secure websites or apps. Avoid phishing scams by never clicking on links in unsolicited emails or texts that claim to offer free credit scores. Be wary of sites that require payment information or ask for too much personal information beyond what’s necessary to verify your identity.

Steps to Improve Your Score Fast

Identify your weaknesses. Take practice tests and carefully review the areas where you struggle. Understanding your weaknesses is the first step to addressing them. Focus your study efforts on these specific topics rather than trying to learn everything at once. This targeted approach will help you improve your score more efficiently.

Practice consistently. Regular practice is key to improving your score. Set aside dedicated study time each day or week, even if it’s just for a short period. Consistency is more effective than cramming. Use a variety of practice materials, such as practice tests, quizzes, and flashcards, to keep your studies engaging and comprehensive.

Seek help when needed. Don’t be afraid to ask for help if you’re struggling. Consider working with a tutor, joining a study group, or asking your teacher for clarification. Sometimes, an outside perspective can help you understand concepts you’re struggling with. Taking initiative to seek assistance can significantly boost your understanding and ultimately, your score.

Mistakes That Lower Your Score

Several common mistakes can significantly lower your score on any assessment. Ignoring instructions is a major culprit. Failing to read directions thoroughly can lead to missed questions, incorrect formatting, and lost points, even if you understand the material. Poor time management is another frequent issue. Not allocating enough time for each section, or spending too long on difficult questions, can leave you rushing through the rest of the exam and making careless errors.

Lack of preparation is often the root of many problems. Studying insufficiently, or relying on ineffective study methods, can result in a poor understanding of key concepts. This can manifest as difficulty recalling information, misinterpreting questions, and ultimately, choosing incorrect answers. Reviewing mistakes after a previous assessment is crucial for improvement, and failing to do so can perpetuate bad habits and prevent you from identifying areas of weakness.

Finally, anxiety and stress can negatively impact your performance. Feeling overwhelmed during the exam can hinder your ability to focus, recall information, and think critically. Practicing relaxation techniques and maintaining a positive mindset can help mitigate test anxiety and improve your chances of success.

How Long Improvements Take

The timeframe for seeing improvements varies greatly depending on the specific area of focus. Consistency and effort are key factors. Simple habits, like daily reading, might show noticeable improvements in weeks or months. More complex skills, like learning a new language or musical instrument, often require sustained effort over many months or even years. Physical changes, such as weight loss or muscle gain, also depend on individual factors and typically occur gradually over time.

It’s important to establish realistic expectations and avoid discouragement if progress seems slow. Tracking progress can be a helpful motivator, whether it’s noting words learned, pounds lost, or minutes practiced. Remember that setbacks are normal, and the journey towards improvement is often non-linear. Focus on the process and celebrate small victories along the way.

Several factors can influence the speed of improvement. These include the complexity of the skill or goal, the amount of time dedicated to practice, the quality of instruction or resources, individual aptitude, and pre-existing knowledge or skills. While some individuals may see rapid progress, others may require more time and effort. Patience and persistence are crucial for long-term success.

Myths About Credit Scores

Many people believe misinformation about how credit scores are calculated and used. One common myth is that checking your own credit score will lower it. This is false. Checking your own score is considered a “soft inquiry” and has no impact on your score. Only “hard inquiries,” such as those from lenders when you apply for credit, can potentially affect your score. Another misconception is that closing old credit cards always improves your score. While it can be helpful in some cases, closing a long-standing account with a good history can actually hurt your score by shortening your credit history and increasing your credit utilization ratio.

Another persistent myth is that paying off debt immediately after it goes to collections removes it from your credit report. Unfortunately, this is not true. While paying off collections is important and demonstrates financial responsibility, the collection entry will likely remain on your report for up to seven years. Paying off the debt prevents further damage, but it doesn’t erase the past event. It’s important to address collections and work towards a positive payment history moving forward.

Finally, some people believe that their income directly impacts their credit score. This is incorrect. Your credit score is based on your credit behavior, not your earning potential. Factors considered are payment history, amounts owed, length of credit history, new credit, and credit mix. Focus on responsible credit management, regardless of your income level, to build a strong credit profile.