Planning for a secure retirement requires careful consideration of your financial resources, and a 401(k) is often a powerful tool to help you achieve your long-term goals. This comprehensive guide explores how to maximize your 401(k) for maximum retirement growth. We’ll delve into key strategies, including understanding different investment options, optimizing your contribution strategy, and minimizing fees to ensure your 401(k) works as hard as possible for you.

Whether you are just beginning your career or nearing retirement, understanding how to effectively utilize your 401(k) is crucial. This article will provide you with the knowledge to make informed decisions about your 401(k) investments, helping you navigate the complexities of retirement planning and work towards a financially secure future. From asset allocation to catch-up contributions, learn how to leverage your 401(k) to its full potential and build the retirement nest egg you deserve.

What Is a 401(k) Plan?

A 401(k) plan is a tax-advantaged retirement savings plan sponsored by employers. It allows employees to contribute a portion of their pre-tax salary to invest for retirement. Contributions grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw the money in retirement. Many employers also offer a matching contribution up to a certain percentage of your salary, which is essentially free money towards your retirement.

There are two main types of 401(k) plans: traditional and Roth. Traditional 401(k) contributions are made pre-tax, reducing your current taxable income. Roth 401(k) contributions are made after-tax, meaning you won’t receive a tax break now, but qualified withdrawals in retirement are tax-free. The best choice for you depends on your individual financial situation and tax bracket.

Upon leaving your job, you generally have several options for your 401(k) balance. You can leave it in your former employer’s plan, roll it over to a new employer’s plan if available, or roll it over to a traditional IRA or Roth IRA.

Employer Match and How It Works

An employer match is a powerful employee benefit offered by many companies as part of their retirement savings plans, most commonly 401(k)s. In essence, your employer contributes a certain amount of money to your retirement account based on your own contributions. This is essentially “free” money that helps you grow your retirement nest egg faster. Understanding how your company’s specific matching program works is crucial to maximizing your retirement savings.

Matching formulas vary. Some employers match dollar-for-dollar up to a certain percentage of your salary, while others may match a portion of your contribution (e.g., 50 cents on the dollar). There’s also typically a cap on the maximum amount the employer will contribute, often expressed as a percentage of your salary. For example, an employer might match 100% of your contributions up to 6% of your salary. If you earn $50,000 and contribute 6% ($3,000), your employer will also contribute $3,000. Contributing more than 6% in this scenario won’t result in a larger match. It is important to review your employer’s plan documents to fully understand the details of their matching program.

Taking full advantage of the employer match is a vital part of a sound retirement savings strategy. By contributing enough to receive the full match, you’re essentially getting a guaranteed return on your investment. Failing to contribute enough to maximize the match is like leaving free money on the table. Consult with a financial advisor if you have questions about your specific situation or need help developing a retirement savings plan.

Contribution Limits and Catch-Up Rules

Contribution limits are the maximum amounts individuals can contribute to certain retirement accounts each year. These limits are set by the Internal Revenue Service (IRS) and are subject to change annually. Understanding these limits is crucial for effective retirement planning and avoiding potential penalties. Exceeding the contribution limits can result in tax penalties, so it is important to stay informed about the current limits.

Catch-up contributions allow individuals age 50 and older to contribute additional amounts to their retirement accounts beyond the standard limits. This provision acknowledges that older individuals may have less time to save for retirement and provides them with an opportunity to boost their savings in later years. These catch-up contributions can significantly impact an individual’s retirement readiness. The specific catch-up contribution amounts are also subject to annual adjustments by the IRS.

It is highly recommended to consult a qualified financial advisor for personalized guidance on contribution limits and catch-up rules based on your individual circumstances. They can help you determine the appropriate contribution strategy to maximize your retirement savings while staying within the IRS guidelines.

Best Investment Options Within a 401(k)

A 401(k) offers several investment avenues, each carrying a different level of risk and potential return. Target-date funds are a popular choice, particularly for those new to investing. These funds automatically adjust their asset allocation based on your projected retirement date, shifting from higher-risk investments like stocks to more conservative options like bonds as you approach retirement. Another common option is index funds, which passively track a specific market index like the S&P 500, offering broad diversification and typically lower expense ratios compared to actively managed funds. Finally, actively managed funds are professionally managed with the goal of outperforming the market, but often come with higher fees.

Choosing the right investment mix depends heavily on your individual circumstances, including your risk tolerance, time horizon, and overall financial goals. Individuals with a longer time horizon until retirement can typically afford to take on more risk, potentially allocating a larger portion of their portfolio to stocks. Conversely, those closer to retirement may prefer a more conservative approach, favoring bonds and other fixed-income investments. It’s important to remember that past performance is not indicative of future results and diversification is a key element of a sound investment strategy. Regularly reviewing and rebalancing your portfolio is crucial to ensure it remains aligned with your goals.

Before making any investment decisions, carefully review your 401(k) plan’s investment options and consider consulting with a qualified financial advisor. They can help you determine an appropriate asset allocation based on your specific situation. Understanding the fees and expenses associated with each investment option is also critical, as these can significantly impact your long-term returns.

Managing Risk by Age

Younger adults (typically under 40) often have a longer time horizon to recover from financial setbacks, allowing them to take on more risk in their investments. This might include allocating a larger portion of their portfolio to stocks or exploring higher-risk, higher-reward opportunities like starting a business. They may also have less need for liquid assets, as they are less likely to have immediate, large expenses like a down payment on a house or funding a child’s education.

As individuals approach middle age (roughly 40-60), their risk tolerance typically decreases. They may shift towards a more balanced portfolio with a greater emphasis on preserving capital. This could involve increasing their allocation to bonds and other fixed-income investments. Retirement planning becomes a primary focus, and they may prioritize paying down debt and building a stable financial foundation.

Older adults (60+) generally favor a conservative approach to risk management. Preserving capital and generating income are key priorities. Their investment portfolios may be heavily weighted towards bonds and other lower-risk assets. They may also prioritize estate planning and ensuring they have sufficient resources to cover healthcare expenses.

Rolling Over When You Change Jobs

When you leave a job, you often have the option to roll over your 401(k) or other employer-sponsored retirement savings plan into a new account. This is an important decision with several options to consider. You can roll it into your new employer’s plan, if available, roll it into a traditional IRA (Individual Retirement Account), or roll it into a Roth IRA. Each option has different tax implications and rules, so it’s crucial to understand the differences before making a decision.

Rolling your 401(k) into an IRA allows you to maintain control over your investments and potentially consolidate your retirement savings. A traditional IRA rollover preserves the tax-deferred status of your funds, meaning you’ll pay taxes when you withdraw the money in retirement. A Roth IRA rollover, on the other hand, involves paying taxes now but allows for tax-free withdrawals in retirement. Choosing the right option depends on your individual financial circumstances and retirement goals.

If you are unsure about the best course of action, consulting with a qualified financial advisor is highly recommended. They can help you evaluate your options and make an informed decision that aligns with your long-term financial plan.

Tax Implications You Should Know

Understanding tax implications is crucial for making informed financial decisions. Taxes affect various aspects of your finances, from income and investments to property and estate planning. Failing to consider these implications can lead to unexpected expenses and reduced overall returns. Being aware of potential tax liabilities empowers you to strategize effectively and minimize your tax burden.

Key areas to consider include income tax on earnings, capital gains tax on investments, property tax on real estate, and estate tax on inherited assets. Each of these areas has its own set of rules and regulations, which can be complex and vary depending on individual circumstances. Consulting with a qualified tax professional can provide personalized guidance and ensure you comply with all applicable laws.

By understanding the tax implications associated with various financial decisions, you can make smarter choices and potentially save a significant amount of money. This includes considering tax-advantaged investment options, exploring deductions and credits, and planning for future tax liabilities. Proactive tax planning is essential for maximizing your financial well-being.

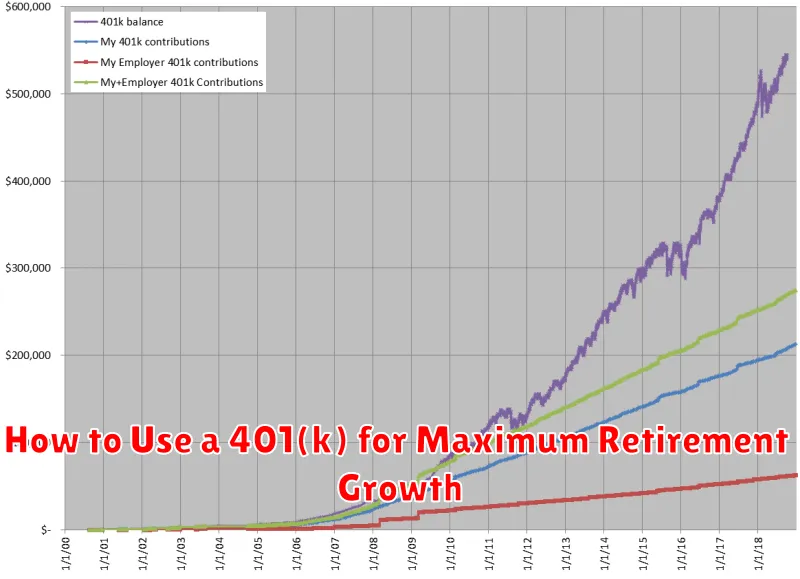

Tracking Performance Over Time

Tracking performance over time is crucial for understanding trends, identifying areas for improvement, and measuring the impact of changes. Whether analyzing business metrics, athletic progress, or academic achievement, consistent monitoring provides valuable insights. Establishing clear metrics and regularly collecting data are the first steps in this process. This data can then be visualized through charts and graphs to highlight patterns and progress.

Choosing the right time intervals for tracking is important. Depending on the specific goal, data might be collected daily, weekly, monthly, or even annually. For example, a sales team might track daily sales figures, while a project manager might monitor progress on milestones weekly. The frequency should be appropriate for the nature of the data and the desired level of detail. Consistency in data collection is essential for accurate analysis and meaningful comparisons.

By consistently tracking performance, individuals and organizations can identify strengths, weaknesses, and opportunities. This information empowers data-driven decision-making and facilitates continuous improvement. Regular review of performance data enables proactive adjustments to strategies and processes, ultimately leading to better outcomes and achieving established goals.