Expecting a baby is a joyous occasion, but it’s also a time of significant financial transition. Financially preparing for a baby is crucial for navigating the added expenses and ensuring a secure future for your growing family. This article will provide a comprehensive guide to help you understand and plan for the financial implications of having a baby, covering everything from budgeting for baby essentials and healthcare costs to exploring childcare options and adjusting your insurance coverage. Whether you’re a first-time parent or expanding your family, understanding how to financially prepare for a child will empower you to make informed decisions and embrace parenthood with greater confidence.

From diapers and formula to healthcare visits and childcare, the costs associated with having a baby can quickly add up. Developing a baby budget is a fundamental step in financial preparation for parenthood. We’ll walk you through creating a realistic budget that accounts for both expected and unexpected expenses. This guide will delve into essential topics such as understanding newborn expenses, comparing childcare costs, managing healthcare expenses for babies, and making informed decisions about life insurance and college savings. With careful planning and preparation, you can navigate the financial aspects of having a baby and build a strong foundation for your family’s future.

Estimating the Cost of a Newborn

Welcoming a newborn is a joyous occasion, but it’s also essential to be financially prepared. The first year with a baby can bring significant expenses. While the precise cost varies based on several factors, including geographic location, insurance coverage, and individual choices, expecting parents can anticipate spending a substantial amount. Key expenses include hospital delivery fees, which can range widely, prenatal care, and the first year’s well-baby visits. Additional costs to consider are food, diapers, clothing, crib, stroller, car seat, and other baby gear.

Healthcare is a significant portion of newborn expenses. Even with insurance, out-of-pocket costs for deductibles, copays, and coinsurance can add up quickly. It is crucial to understand your insurance policy and factor in potential costs for unforeseen medical needs. Beyond immediate medical costs, consider ongoing expenses such as formula (if not breastfeeding) and regular checkups. Creating a budget that accounts for these recurring expenses is essential for financial stability.

Careful planning and budgeting can alleviate some financial stress associated with a new baby. Researching the costs of essential items and services in your area is a good starting point. Consider creating a baby registry to help offset the cost of some items. Additionally, explore potential childcare options early, as these costs can be substantial. Being proactive and informed about potential expenses will contribute to a smoother transition into parenthood.

Health Insurance and Delivery Costs

Health insurance plays a vital role in financing healthcare services, protecting individuals from the potentially devastating financial burden of medical expenses. The cost of health insurance premiums varies depending on factors such as the type of plan (e.g., HMO, PPO), the level of coverage, and individual characteristics like age and health status. Employer-sponsored insurance is a common way to obtain coverage, with employers often contributing to premium costs. Government programs like Medicare and Medicaid provide coverage for specific populations, including seniors and low-income individuals.

Healthcare delivery costs encompass a wide range of expenses associated with providing medical services. These costs include hospital care, physician services, prescription drugs, diagnostic tests, and medical equipment. Several factors contribute to the rising cost of healthcare delivery, including advancements in medical technology, an aging population, and administrative expenses. Managing these costs is a significant challenge for healthcare systems worldwide.

The relationship between health insurance and delivery costs is complex and interconnected. Insurance coverage can influence utilization patterns and, consequently, the overall demand for healthcare services. Payment models, such as fee-for-service and value-based care, further impact how providers deliver care and what services they offer. Policy efforts aimed at controlling healthcare costs often focus on strategies to manage both insurance premiums and delivery expenses, with the goal of improving access to affordable, high-quality care.

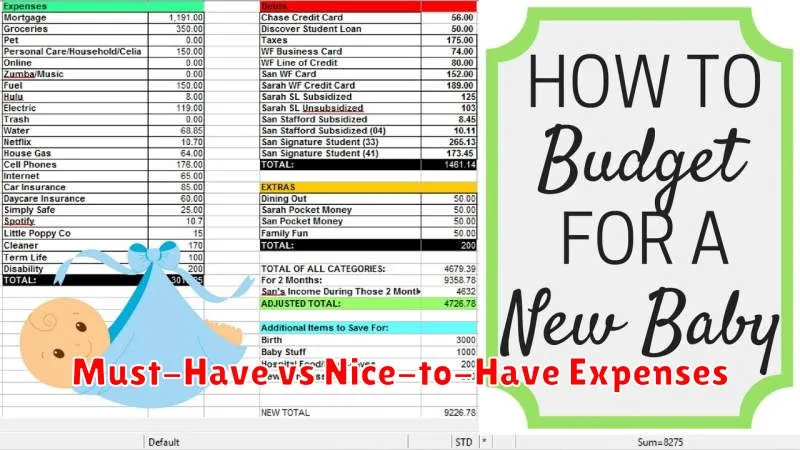

Setting Up a Baby Budget

Preparing for a baby involves significant financial adjustments. Creating a comprehensive budget is essential to manage these new expenses effectively. Start by evaluating your current income and expenses. Identify areas where you can reduce spending to accommodate upcoming baby-related costs. Consider potential changes to your income, especially if one parent plans to take parental leave. Factor in one-time expenses like a crib, stroller, and car seat, as well as recurring costs such as diapers, formula or breastfeeding supplies, and childcare.

Researching the cost of baby items and services in your area is crucial for accurate budgeting. Compare prices from different retailers and service providers. Don’t hesitate to consider secondhand options for certain items to save money. Explore potential childcare options early on, as costs can vary significantly depending on your location and the type of care you choose. Factor in potential healthcare expenses, including prenatal care, delivery costs, and regular checkups for your baby. Create a buffer in your budget for unexpected expenses that may arise.

Regularly reviewing and adjusting your budget after your baby arrives is vital. Track your actual spending and compare it to your planned budget. Be prepared to make adjustments as your baby’s needs change and new expenses emerge. Look for ways to continue saving money where possible. Consider building an emergency fund specifically for baby-related expenses. This can help you navigate unforeseen circumstances without derailing your overall financial plan.

Must-Have vs Nice-to-Have Expenses

Distinguishing between must-have and nice-to-have expenses is crucial for effective budgeting and financial stability. Must-have expenses are essential for daily living and cannot be easily eliminated. These include housing, food, utilities, transportation, and healthcare. Without these essentials, basic needs cannot be met. Prioritizing must-have expenses ensures survival and provides a foundation for financial well-being.

Nice-to-have expenses, while enjoyable and often desirable, are not essential for survival. These can include entertainment (e.g., movies, dining out), travel, subscriptions (e.g., streaming services), and luxury items. While these expenses can enhance quality of life, they can be reduced or eliminated during times of financial hardship or when prioritizing savings goals. Differentiating between wants and needs allows for more conscious spending and better allocation of resources.

Effectively categorizing expenses allows for better financial management. By prioritizing must-haves and consciously evaluating nice-to-haves, individuals can create a realistic budget, reduce unnecessary spending, and work towards their financial goals. This practice promotes financial health and reduces the risk of overspending and debt accumulation.

Planning for Parental Leave

Planning for parental leave is crucial for both parents and employers. For expecting parents, it involves understanding their legal rights regarding leave duration and pay, as well as making arrangements for childcare and household responsibilities during their absence. This might include researching daycare options, arranging for family assistance, or hiring temporary help. Financial planning is also a key component, involving budgeting for potential changes in income and increased childcare costs. Taking the time to create a detailed plan can ease the transition into parenthood and ensure a smoother return to work.

For employers, preparing for an employee’s parental leave involves several key steps. These include identifying and training a temporary replacement to cover the employee’s responsibilities, ensuring a clear handover of projects and tasks, and establishing communication protocols to stay connected with the employee during their leave. Maintaining open communication and providing support throughout the process can contribute to a positive experience for the employee and a seamless transition back into the workplace.

Successful parental leave requires proactive planning and open communication. By understanding their rights and responsibilities and collaborating effectively, both parents and employers can navigate this transition smoothly, fostering a positive and supportive environment for families and workplaces.

Building a Safety Net

Building a financial safety net is crucial for navigating unexpected life events. This safety net acts as a buffer against job loss, medical emergencies, or unforeseen expenses. It provides peace of mind and allows you to weather financial storms without accumulating excessive debt or drastically altering your lifestyle. Starting with a small emergency fund and gradually building it is a significant first step.

A key component of a safety net is having an emergency fund. This fund should ideally cover 3-6 months of essential living expenses. Consider costs like rent/mortgage, utilities, groceries, transportation, and debt payments. Keep this money in a readily accessible, high-yield savings account separate from your regular checking account to avoid accidental spending.

Beyond an emergency fund, other elements contribute to a strong financial safety net. These include adequate insurance coverage (health, auto, home, etc.), a manageable debt load, and a long-term savings plan for retirement. Building a safety net is an ongoing process, but the security and stability it offers are invaluable.

Saving for Childcare and Education

Childcare and education costs are significant expenses for families. Starting early and saving consistently can help alleviate the financial burden. Several options are available, including 529 plans, which offer tax advantages for qualified education expenses, and custodial accounts, which offer flexibility but have potential tax implications. Consider your family’s financial situation and long-term goals when choosing a savings strategy.

Creating a budget and identifying areas where you can reduce spending can free up funds for saving. Automating regular contributions to your chosen savings plan can make the process easier and ensure consistent growth. Even small amounts saved regularly can add up over time, thanks to the power of compounding.

Researching available financial aid options, such as grants and scholarships, can also help offset the cost of education. Begin exploring these options early in your child’s academic career. Remember, planning and saving early, even in small increments, is crucial to securing your child’s future.

Involving Your Partner in the Planning

Wedding planning can be overwhelming, and it’s crucial to involve your partner from the start. Open communication is key. Discuss your vision for the wedding, including budget, guest list size, and overall style. Schedule regular planning sessions to make decisions together and divide tasks based on your strengths and interests. This shared responsibility will not only reduce stress but also make the process more enjoyable for both of you.

Consider your partner’s personality and preferences when assigning tasks. If your partner is detail-oriented, they might enjoy managing the budget or researching vendors. If they’re more creative, perhaps they could take the lead on designing invitations or choosing the music. Collaboration is essential, so be sure to discuss each decision together, even if one person takes the lead on a particular aspect. Remember, this is your wedding, and it should reflect both of your personalities.

Don’t be afraid to compromise. It’s unlikely that you’ll agree on every single detail. Be willing to listen to your partner’s ideas and find solutions that work for both of you. Focus on the bigger picture and remember that the most important thing is celebrating your love and commitment with the people you care about. Working together throughout the planning process will strengthen your bond and set a positive foundation for your marriage.