Deciding on the right retirement savings plan can be a daunting task, and choosing between a Traditional IRA and a Roth IRA is a common dilemma. This article will explore the key differences between these two powerful retirement vehicles, helping you determine if a Roth IRA is the right choice for your individual financial circumstances. We’ll delve into the benefits of a Roth IRA, including tax-free withdrawals in retirement, and consider the eligibility requirements, contribution limits, and potential drawbacks to help you make an informed decision about your financial future.

A Roth IRA offers distinct advantages, especially for those who anticipate being in a higher tax bracket in retirement. By contributing after-tax dollars today, you can enjoy tax-free withdrawals of both contributions and earnings later. Understanding how a Roth IRA works, its potential impact on your long-term savings, and how it compares to other retirement options like a Traditional IRA is crucial for maximizing your retirement nest egg. Is a Roth IRA right for you? This article aims to provide you with the information you need to answer that question with confidence.

What Is a Roth IRA?

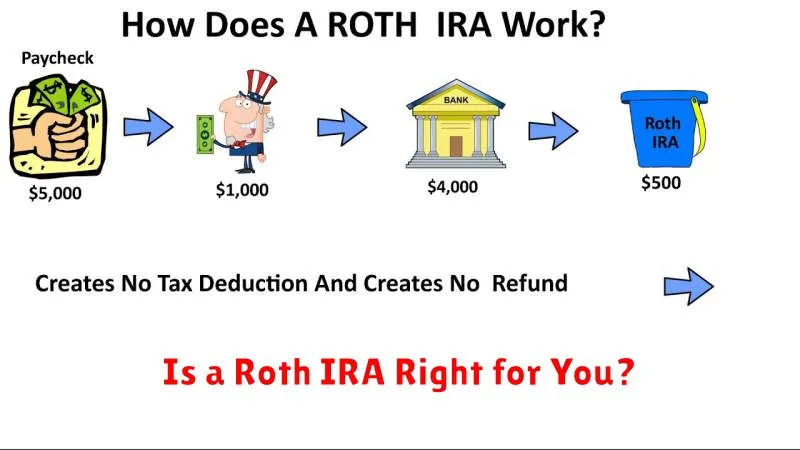

A Roth IRA (Individual Retirement Account) is a tax-advantaged investment account designed to help individuals save for retirement. Contributions are made with after-tax dollars, meaning you pay income taxes on the money before you deposit it. The key benefit is that qualified withdrawals in retirement, including both contributions and earnings, are tax-free. This differs from a traditional IRA, where contributions may be tax-deductible, but withdrawals are taxed in retirement.

Roth IRAs offer several advantages for retirement savers. The tax-free withdrawals can be particularly beneficial if you anticipate being in a higher tax bracket in retirement than you are currently. They also provide flexibility, as contributions can be withdrawn at any time without penalty. However, earnings withdrawn before age 59 1/2 are generally subject to a 10% additional tax unless certain exceptions apply. There are also income limitations that may restrict your eligibility to contribute to a Roth IRA.

Several factors should be considered when deciding if a Roth IRA is right for you. Your current and projected future tax bracket is a key consideration. If you expect your tax rate to be higher in retirement, a Roth IRA can be a valuable tool. Other factors include your retirement goals, your current savings, and your overall financial situation. It’s often helpful to consult with a financial advisor to determine the best strategy for your individual needs.

Traditional vs Roth IRA Comparison

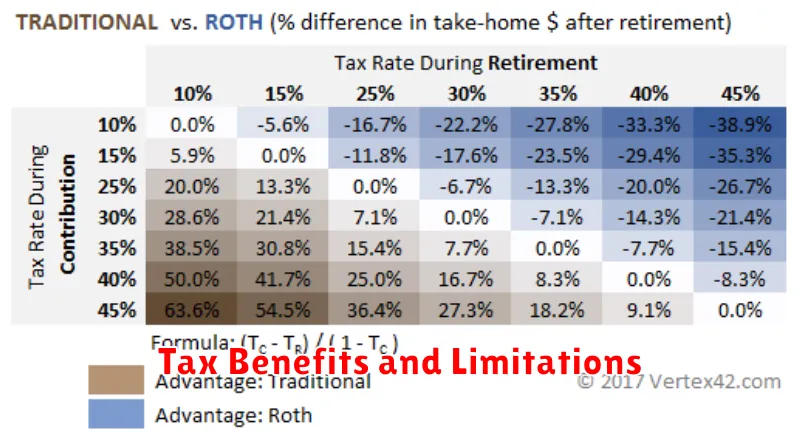

Choosing between a Traditional and a Roth IRA depends on your individual circumstances and financial goals. A Traditional IRA offers tax-deductible contributions now, lowering your current taxable income. However, your withdrawals in retirement are taxed. This makes it a potentially good choice if you anticipate being in a lower tax bracket during retirement than you are currently. Key factors include your current and projected future income, as well as your current tax bracket.

A Roth IRA, conversely, doesn’t offer the upfront tax deduction. Your contributions are made with after-tax dollars. The significant advantage, however, is that your qualified withdrawals in retirement are tax-free. This makes a Roth IRA a compelling option if you expect to be in a higher tax bracket in retirement or want tax-free income later in life. It’s also particularly beneficial for younger investors who are likely in a lower tax bracket now and have more time for their investments to grow tax-free.

Here’s a simple breakdown:

- Traditional IRA: Tax deduction now, taxed withdrawals later.

- Roth IRA: No tax deduction now, tax-free withdrawals later.

It’s always recommended to consult with a financial advisor to determine which IRA is best suited for your specific situation.

Who Can Contribute to a Roth IRA?

Eligibility to contribute to a Roth IRA hinges primarily on having earned income. This means income from a job, self-employment, or other taxable compensation. Simply having investment income, such as dividends or capital gains, is not sufficient. Additionally, your income must fall below certain limits. These limits are adjusted annually by the IRS.

Even if your income exceeds the contribution limits, you may still be able to make partial contributions. The amount you can contribute is phased out based on your modified adjusted gross income (MAGI). You should consult the current IRS guidelines for the specific income limits and phase-out ranges.

Unlike Traditional IRAs, there is no age limit for contributing to a Roth IRA. As long as you have earned income and your income is below the specified limits, you can contribute regardless of age.

Tax Benefits and Limitations

Tax benefits often incentivize specific behaviors, such as charitable giving or retirement savings. These can include deductions, which reduce taxable income, and credits, which directly offset tax liability. Understanding these benefits is crucial for effective financial planning. For example, contributing to a tax-deferred retirement account can significantly reduce your current tax burden while simultaneously building wealth for the future.

However, tax benefits often come with limitations. These limitations can include income restrictions, contribution limits, or phase-out ranges. For instance, deductions for certain expenses might be capped at a specific dollar amount, while eligibility for certain credits might be phased out based on income level. It is essential to be aware of these limitations to avoid unexpected tax liabilities and maximize your tax savings.

Careful consideration of both the benefits and limitations is crucial for sound financial decision-making. Consulting with a qualified tax professional can provide personalized guidance and ensure compliance with current tax laws and regulations.

Withdrawal Rules and Penalties

Understanding withdrawal rules and penalties is crucial before investing. These rules vary depending on the specific investment product. Penalties may include surrender charges, loss of interest, or tax implications. Always review the terms and conditions carefully before committing funds.

Common reasons for imposing penalties include discouraging early withdrawals and compensating the financial institution for administrative costs. For example, with Certificates of Deposit (CDs), withdrawing funds before maturity often results in a penalty equivalent to a certain number of months’ worth of interest. Similarly, some retirement accounts may impose a 10% penalty on withdrawals made before a certain age.

To avoid penalties, consider alternatives such as short-term investments or products with more flexible withdrawal options. Consulting a financial advisor can help you understand the potential penalties associated with different investments and choose the most suitable options for your financial goals.

How to Open a Roth IRA

Opening a Roth IRA is a smart move for long-term retirement savings. You contribute after-tax dollars, but your withdrawals in retirement are tax-free. To get started, you’ll need to choose a financial institution like a brokerage firm, bank, or credit union. Research different institutions to compare fees, investment options, and available resources. Once you’ve made your choice, you can typically open an account online or in person. You’ll need to provide some personal information like your Social Security number and employment details.

When opening your Roth IRA, you’ll need to decide how you want to invest your contributions. You can choose from a variety of options including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider your risk tolerance and investment timeline when making your selections. It’s also wise to diversify your investments to help manage risk. Many institutions offer tools and resources to help you create a diversified portfolio.

There are contribution limits to Roth IRAs that adjust periodically. Be sure to check the current limits to ensure you don’t over-contribute. Also, be aware of income limitations. If your income exceeds a certain threshold, you may not be eligible to contribute to a Roth IRA, or your contributions may be reduced. After your account is open, set up regular contributions. Even small, consistent contributions can grow significantly over time thanks to the power of compounding.

Strategies for Long-Term Growth

Long-term growth requires a multifaceted approach focusing on sustainability and adaptability. This involves strategically allocating resources, fostering innovation, and building a resilient business model. Consider diversifying your product or service offerings to mitigate risk and capitalize on emerging market trends. Prioritize customer satisfaction and retention, as strong customer relationships are crucial for sustained growth. Regularly analyze your performance metrics to identify areas for improvement and ensure you’re staying on track to meet your long-term goals.

Another critical aspect of long-term growth is investment. This includes investing in your employees through training and development programs to enhance their skills and productivity. Investing in research and development is equally important for staying ahead of the competition and creating innovative products or services. Furthermore, consider strategic partnerships and acquisitions that can expand your market reach and bring in valuable expertise.

Finally, strong leadership is essential to guide the organization through the complexities of long-term growth. Leaders must establish a clear vision and communicate it effectively to the entire team. They should foster a culture of collaboration and continuous improvement, empowering employees to contribute to the company’s success. By focusing on these key strategies, businesses can position themselves for sustainable growth and long-term prosperity.

Common Roth IRA Mistakes

One common mistake is contributing too much to a Roth IRA. Contribution limits change annually, and exceeding them can result in penalties. It’s crucial to stay updated on the current limits and ensure your contributions fall within the allowed range. Additionally, your income must be below a certain threshold to be eligible for contributions. Reviewing the income limitations each year is vital to avoid penalties.

Another frequent error is withdrawing earnings too early. While contributions can be withdrawn tax-free and penalty-free at any time, the same isn’t true for earnings. Withdrawing earnings before age 59 1/2 can result in a 10% penalty, along with owing income tax, unless certain exceptions apply. Understanding the 5-year rule is also essential, as it dictates when qualified distributions of earnings can be made tax-free. This rule starts with the first tax year you make a Roth IRA contribution.

Failing to consider a Roth IRA altogether is another significant mistake. While traditional IRAs offer upfront tax deductions, Roth IRAs offer tax-free withdrawals in retirement. This can be particularly advantageous if you anticipate being in a higher tax bracket later in life. Carefully evaluating your current and projected tax situations is crucial to determine which type of IRA is best suited for your long-term financial goals.