Saving for a down payment on a house can feel like a daunting task, but with a clear plan and consistent effort, it’s entirely achievable. This article will provide you with practical strategies and actionable steps to effectively save for the down payment on your dream home. We’ll cover topics ranging from budgeting and cutting expenses to exploring various down payment assistance programs. Whether you’re a first-time homebuyer or looking to upgrade to a new property, understanding how to save for a down payment is crucial.

Navigating the complexities of down payments can be challenging. From understanding how much you need to save to choosing the right savings strategies, there are numerous factors to consider. This guide will break down the process, offering valuable insights on how to save for a down payment efficiently and effectively. We’ll explore different down payment percentages, the impact on your mortgage, and tips for accelerating your savings journey to achieve your homeownership goals sooner.

What Is a Down Payment?

A down payment is an upfront payment you make when purchasing a significant item, most commonly a home or a vehicle. It represents a percentage of the total purchase price and is paid in cash at the time of closing the deal. The remaining balance is typically financed through a loan.

The size of your down payment can significantly impact the terms of your loan. A larger down payment generally results in a lower loan amount, which can lead to lower monthly payments and a lower interest rate. It can also help you avoid private mortgage insurance (PMI) if you’re buying a home.

While the minimum down payment requirement varies depending on the lender and the type of purchase, common minimums for homes are often between 3% and 20% of the purchase price. For vehicles, down payments can range from 0% to a substantial portion of the vehicle’s cost, depending on your creditworthiness and the specific financing deal.

How Much Do You Need?

Determining “how much” requires careful consideration of your specific goals and circumstances. Whether you’re assessing financial needs, resources for a project, or ingredients for a recipe, clearly defining your objectives is the crucial first step. For example, if you are saving for a down payment on a house, you need to establish the target purchase price and desired down payment percentage. This will give you a concrete savings goal.

Once your objective is defined, you can begin to quantify the necessary components. This might involve creating a budget, researching material costs, or calculating ingredient quantities. Accurate measurement and careful estimation are essential for ensuring you have sufficient resources to achieve your goal. Don’t forget to factor in potential variations or unexpected expenses. Adding a buffer to your initial estimate can provide valuable flexibility.

Finally, regular review and adjustment are vital. As circumstances change, your needs may also shift. Periodically re-evaluating your initial calculations will help you stay on track and ensure you remain adequately resourced to meet your objectives. This could involve revising your budget, sourcing alternative materials, or adjusting your savings plan.

Setting a Realistic Timeline

Setting a realistic timeline is crucial for project success. Accurately estimating the time required for each task prevents unrealistic expectations and allows for effective resource allocation. Consider potential roadblocks, dependencies between tasks, and allocate buffer time for unexpected delays. This proactive approach minimizes the risk of schedule overruns and ensures a smoother project execution.

Begin by breaking down the project into smaller, manageable tasks. Assign realistic deadlines to each of these sub-tasks, considering the complexity and resources available. Involving team members in this process can provide valuable insight and foster a sense of ownership, leading to more accurate time estimations and increased commitment to meeting deadlines.

Regularly review and adjust the timeline as the project progresses. Monitoring milestones and identifying potential bottlenecks early on allows for timely adjustments, minimizing the impact of unexpected issues. Flexibility is key to effectively managing a project timeline and ensuring successful completion within the allocated timeframe.

Choosing the Right Savings Account

Selecting the right savings account is a crucial step in achieving your financial goals. It’s essential to consider several factors to ensure the account aligns with your needs. You should carefully evaluate the interest rate offered. A higher interest rate allows your savings to grow more quickly. Fees can significantly impact your returns, so look for accounts with minimal or no monthly maintenance fees, overdraft fees, or other charges. Finally, consider the accessibility of your funds. Some accounts may have restrictions on withdrawals or transfers, while others offer convenient online and mobile banking options. Understanding these key elements will empower you to choose an account that maximizes your savings potential.

Different types of savings accounts cater to various saving styles. A basic savings account offers a simple way to store and access your funds. A high-yield savings account typically offers a higher interest rate but may come with specific requirements, such as minimum balance requirements. Money market accounts often combine features of checking and savings accounts, providing check-writing capabilities and higher interest rates. Consider your saving habits and preferences when selecting the type of account that best suits your needs.

Before opening an account, it’s always wise to compare offerings from different financial institutions. Don’t settle for the first account you come across. Research banks, credit unions, and online banks to identify the best interest rates, lowest fees, and most convenient features. Reading reviews and comparing account details can help you make an informed decision and select the savings account that best supports your financial objectives.

Cutting Expenses to Reach Your Goal

Reaching your financial goals, whether it’s buying a house, paying off debt, or early retirement, often requires careful management of your expenses. Identifying and reducing unnecessary spending can significantly accelerate your progress. Start by tracking your spending for a month to understand where your money goes. This can be done through budgeting apps, spreadsheets, or even a simple notebook.

Once you have a clear picture of your spending habits, look for areas where you can cut back. Common areas include dining out, entertainment subscriptions, and impulse purchases. Consider reducing your grocery bill by meal planning and using coupons. Negotiating lower rates for services like insurance and internet can also save you money. Small changes can add up to significant savings over time.

Prioritize your spending based on your goals. If saving for a down payment is your priority, you may need to temporarily reduce spending on non-essential items. Remember, cutting expenses doesn’t mean depriving yourself. It’s about making conscious choices and redirecting your money towards your most important financial goals.

Boosting Income Through Side Gigs

In today’s economy, many individuals are seeking ways to supplement their income. Side gigs offer a flexible and potentially lucrative solution. These opportunities range from freelance work and online tutoring to driving for ride-sharing services and selling handmade crafts. Choosing the right side gig depends on your skills, available time, and financial goals.

Identifying a suitable side gig requires careful consideration. Think about what you enjoy doing and what you’re good at. Research different options and compare the potential earnings, time commitment, and required resources. For example, freelance writing may require strong writing skills and a reliable computer, while pet sitting might necessitate a love of animals and flexible availability. Weigh the pros and cons of each option before making a decision.

Once you’ve chosen a side gig, managing your time effectively is crucial. Create a schedule that balances your main job, personal life, and side hustle. Set realistic goals for how much time you can dedicate each week and stick to your schedule as much as possible. Effective time management ensures you can maximize your earnings without burning out.

State and Federal Assistance Programs

State and federal governments offer a variety of assistance programs designed to help individuals and families in need. These programs address a range of crucial needs, including housing, food, healthcare, and employment. Eligibility requirements vary depending on the specific program and the state in which you reside. Generally, eligibility is based on factors such as income, household size, and citizenship status.

Federal programs often provide funding and guidelines, while state governments typically administer the programs and determine specific eligibility criteria. Some key federal programs include the Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), and Medicaid. States may also offer their own programs to supplement federal assistance, addressing specific needs within their communities.

To find information about specific programs available in your area, contact your local social services agency or visit your state government’s website. You can also find information about federal programs on the websites of the relevant federal agencies, such as the U.S. Department of Health and Human Services or the U.S. Department of Agriculture. It’s important to thoroughly research available resources and apply for any programs for which you may qualify.

Tracking Your Progress Over Time

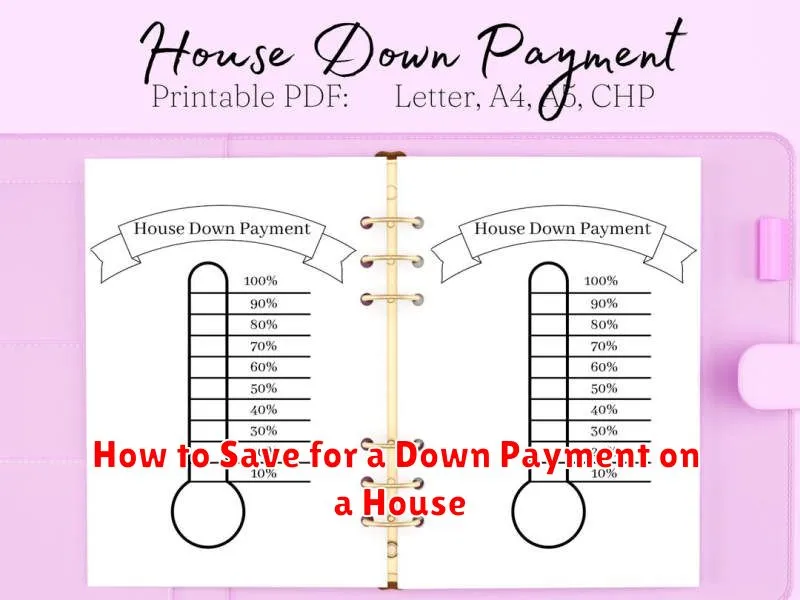

Tracking your progress is crucial for achieving any goal, whether it’s personal, professional, or academic. It allows you to see how far you’ve come, identify areas where you’re excelling, and pinpoint areas needing improvement. Regularly monitoring your progress helps maintain motivation by showcasing your accomplishments and providing a sense of accountability.

There are various methods for tracking progress, including maintaining a journal, using spreadsheets, or employing dedicated progress tracking apps. Choose a method that aligns with your preferences and the nature of your goal. For instance, a journal might be ideal for tracking personal growth, while a spreadsheet is better suited for tracking quantifiable data like sales figures or weight loss. Regardless of the method chosen, ensure it’s consistent and easy to understand.

By actively tracking your progress, you gain valuable insights into your performance and can make necessary adjustments to your strategies. This iterative process of monitoring, evaluating, and adapting is essential for continuous improvement and ultimately, achieving your desired outcomes.