Planning for retirement might seem daunting, especially if you’re just starting out. However, beginning to save for retirement today, no matter how small the amount, can make a significant difference in your future financial security. This article will explore simple ways to save for retirement that you can implement starting today. We’ll cover accessible options for everyone, regardless of income level, and provide practical advice on how to develop strong retirement savings habits.

Building a comfortable retirement nest egg doesn’t require complex investment strategies or large sums of money. By understanding the power of compound interest and taking advantage of accessible retirement savings plans, you can pave the way for a secure financial future. Whether you’re interested in exploring employer-sponsored retirement plans like 401(k)s, or looking into Individual Retirement Accounts (IRAs), you’ll find practical and simple ways to save for retirement starting today within this guide.

Why Saving for Retirement Is Crucial

Retirement planning is often overlooked, especially by younger individuals. However, saving for retirement is crucial for ensuring financial security and maintaining your desired lifestyle later in life. Relying solely on government programs or pensions may not provide sufficient income to cover expenses, particularly with increasing life expectancies. Proactive saving allows you to accumulate a nest egg that can support your needs and provide a comfortable retirement, free from financial worries.

Early and consistent saving offers significant advantages. The power of compounding interest allows your investments to grow exponentially over time. Even small contributions made regularly can accumulate substantial returns over the long term. Furthermore, starting early allows you to weather market fluctuations and adjust your strategy as needed. Delaying saving until later in life necessitates larger contributions to reach the same financial goals, potentially straining your budget and limiting your investment options.

Building a strong retirement foundation requires careful planning and disciplined saving. Consider various investment vehicles, such as 401(k)s, IRAs, and other retirement accounts, to maximize tax advantages and optimize growth potential. Consult with a financial advisor to develop a personalized retirement plan that aligns with your individual goals, risk tolerance, and timeline. By taking proactive steps today, you can secure a financially stable and fulfilling retirement tomorrow.

How Much Should You Save?

Determining precisely how much you should save depends on several key factors, including your age, income, expenses, financial goals, and risk tolerance. A commonly cited rule of thumb is the 50/30/20 budget, where 50% of your after-tax income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment. However, this is a general guideline, and individual circumstances may necessitate adjustments. For example, individuals nearing retirement may need to save a significantly higher percentage of their income.

It’s crucial to establish clear financial goals. Are you saving for a down payment on a house, retirement, your children’s education, or an emergency fund? The purpose of your savings will heavily influence the amount you need to save. For instance, a down payment on a house requires a larger lump sum than building an emergency fund. Once you have defined your goals, you can calculate the necessary savings amount and develop a realistic savings plan.

Beyond general guidelines, it’s highly recommended to consult with a qualified financial advisor. They can provide personalized advice based on your specific financial situation and help you create a tailored savings strategy to achieve your goals effectively. They can also assist with investment strategies to help your savings grow over time.

Types of Retirement Accounts

Individuals planning for retirement have a variety of account options to choose from, each with its own set of advantages and disadvantages. Traditional 401(k) and traditional IRA accounts offer tax-deductible contributions, meaning you reduce your current taxable income. However, withdrawals in retirement are taxed as ordinary income. Roth 401(k) and Roth IRA accounts, conversely, are funded with after-tax dollars, but qualified withdrawals in retirement are tax-free. Choosing the right account type depends on your current income, expected retirement income, and individual financial goals.

Another important distinction is between employer-sponsored plans, such as 401(k)s, and individual retirement accounts (IRAs). Employer-sponsored plans often come with matching contributions from your employer, essentially free money towards your retirement savings. IRAs offer more investment flexibility and can be opened regardless of employment status. Understanding these differences is crucial for maximizing your retirement savings potential.

Finally, individuals who are self-employed or own small businesses have specialized options like SEP IRAs and SIMPLE IRAs. These plans offer tax advantages and streamlined administration for small business owners. Consulting with a financial advisor can help determine the most suitable retirement savings strategy based on your individual circumstances.

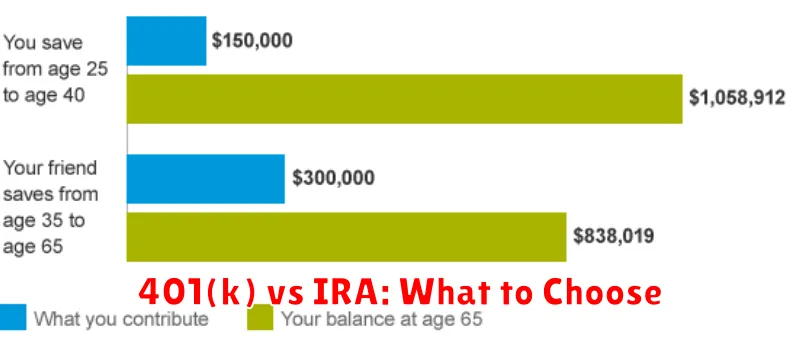

401(k) vs IRA: What to Choose

Deciding between a 401(k) and an IRA can be challenging. A 401(k) is an employer-sponsored retirement plan. Contributions are often tax-deferred, meaning you don’t pay taxes on the money until retirement. Many employers offer matching contributions, essentially free money towards your retirement. Contribution limits for 401(k)s are generally higher than IRAs. However, investment options are often limited to what your employer offers.

An IRA (Individual Retirement Account) offers more investment flexibility. You choose the account and the investments within it. There are two main types: Traditional and Roth. Traditional IRAs may offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. Contribution limits for IRAs are typically lower than 401(k)s.

The best choice depends on your individual circumstances. If your employer offers a 401(k) match, contributing enough to maximize the match is generally recommended. You can then supplement with an IRA. Consider factors such as your current income, tax bracket, and retirement goals when making your decision.

How Compound Interest Works

Compound interest is the interest you earn not only on your initial principal but also on the accumulated interest from previous periods. Think of it as “interest on interest.” This makes your money grow exponentially over time, rather than linearly as with simple interest. The more frequently interest is compounded (e.g., daily, monthly, annually), the faster your balance grows.

To understand how it works, imagine you invest $1,000 at a 10% annual interest rate compounded annually. After the first year, you earn $100 in interest. In the second year, you earn 10% not just on the original $1,000, but on the new balance of $1,100, resulting in $110 interest. This cycle continues, with the interest earned in each period becoming part of the principal for the next period. The key factors influencing compound interest are the principal amount, interest rate, compounding frequency, and time.

The power of compounding becomes particularly significant over long time horizons. Even small initial investments can grow substantially over decades thanks to the snowball effect of reinvested earnings. This makes compound interest a crucial concept for building wealth over the long term, especially for retirement savings.

Automate Your Contributions

Automating contributions, whether to open-source projects, personal finances, or other areas, can significantly boost efficiency and consistency. By leveraging tools and setting up automated processes, you can ensure regular contributions without needing constant manual intervention. This is especially valuable for recurring tasks like code commits, savings deposits, or even social media engagement. Automating these tasks frees up your time and mental energy for more complex and creative endeavors.

There are various methods for automating contributions. For code contributions, consider using tools like continuous integration and continuous deployment (CI/CD) pipelines. These can automate the testing, building, and deployment of your code changes. For financial contributions, explore automated bank transfers or investment platforms that allow recurring deposits. Consistency is key to realizing the benefits of automation, whether it’s compounding interest or building a robust codebase.

Before implementing any automated system, carefully consider the security implications. Ensure that the tools and platforms you use are reputable and secure. Regularly review your automated processes and make adjustments as needed. While automation can be a powerful tool, it’s important to maintain oversight and ensure everything is functioning as intended.

Mistakes to Avoid When Starting

One of the most common mistakes when starting anything new is a lack of planning. Whether it’s a business, a project, or even a new hobby, taking the time to define your goals, research necessary resources, and anticipate potential challenges can save you valuable time and effort down the road. Failing to plan adequately often leads to confusion, frustration, and ultimately, a higher chance of failure. Developing a solid plan, even a simple one, provides a roadmap for success and helps you stay focused on your objectives.

Another critical mistake is underestimating the importance of consistency. Many people start with great enthusiasm, but their motivation wanes over time. Building any new venture requires consistent effort, even when faced with setbacks or slow progress. Establishing a routine and setting realistic, achievable milestones can help maintain momentum and prevent burnout. Remember that consistency breeds habit, and good habits are the foundation of long-term success.

Finally, neglecting to seek feedback can hinder your progress significantly. While self-assessment is valuable, external perspectives can offer insights you may have overlooked. Asking for feedback from trusted sources, mentors, or even potential customers can help you identify weaknesses, refine your approach, and ultimately achieve better results. Don’t be afraid of constructive criticism; embrace it as an opportunity for growth and improvement.

Start Early, Retire Easier

Saving for retirement can feel daunting, but starting early makes a huge difference. Even small contributions made consistently over time can grow significantly thanks to the power of compounding interest. The earlier you begin, the more time your investments have to grow, and the less you’ll need to contribute each month to reach your retirement goals.

Time is your greatest asset when it comes to retirement planning. Delaying saving, even by a few years, can significantly impact your final retirement nest egg. For example, someone who starts saving $200 a month at age 25 will likely have accumulated considerably more by age 65 than someone who waits until age 35 to begin, even if they contribute a higher amount monthly. This is because the earlier investor benefits from decades of compound growth.

Take advantage of employer-sponsored retirement plans, such as 401(k)s, especially if they offer matching contributions. This is essentially free money that accelerates your savings progress. If your employer doesn’t offer a retirement plan, consider opening an Individual Retirement Account (IRA). Consulting with a financial advisor can also provide personalized guidance tailored to your specific situation and goals.