Understanding the fundamentals of investing can be daunting, especially when faced with the decision of choosing between stocks and bonds. This article delves into the core differences between these two popular investment options, outlining the potential risks and rewards associated with each. Whether you are a seasoned investor or just beginning to explore the world of finance, grasping the distinctions between stocks and bonds is crucial for building a diversified and successful investment portfolio. Learning the basics of stock market investing and bond market investing will empower you to make informed decisions aligned with your financial goals.

Investing in stocks, also known as equities, represents ownership in a company. Conversely, investing in bonds essentially means lending money to a corporation or government. This fundamental difference leads to variations in risk tolerance, potential returns, and overall investment strategies. By comparing and contrasting stocks and bonds, you can determine which asset class, or combination thereof, is best suited to your individual investment objectives and risk profile. This article will provide you with a comprehensive overview of stock investments and bond investments, enabling you to navigate the complexities of the financial markets with greater confidence.

What Are Stocks and Bonds?

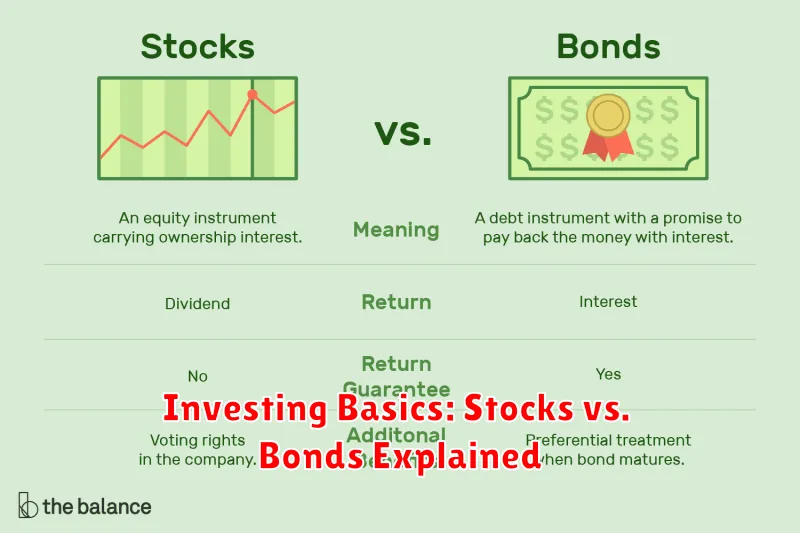

Stocks, also known as equities, represent ownership in a company. When you purchase stock, you become a shareholder and own a small piece of that company. Your ownership stake entitles you to a portion of the company’s profits, distributed as dividends, and allows you to vote on certain corporate matters. Stock prices fluctuate based on company performance, market conditions, and investor sentiment. Investing in stocks offers the potential for higher returns but also carries greater risk compared to other investments.

Bonds, on the other hand, are debt securities. When you buy a bond, you are essentially lending money to a company or government. In return, the issuer promises to pay you back the principal amount at a specified maturity date, along with periodic interest payments, known as coupon payments. Bonds are generally considered less risky than stocks and offer a more predictable income stream. However, their potential for growth is typically lower.

Both stocks and bonds play important roles in a diversified investment portfolio. Stocks offer growth potential, while bonds provide stability and income. The specific allocation between stocks and bonds depends on an individual’s risk tolerance, investment goals, and time horizon.

When Bonds Make Sense

Bonds can be a valuable component of a diversified investment portfolio. They generally offer a lower level of risk compared to stocks and can provide a steady stream of income through interest payments. Bonds make particular sense for investors who prioritize capital preservation, such as those approaching retirement or those with a lower risk tolerance. Additionally, bonds can act as a stabilizing force during periods of market volatility, potentially offsetting losses in other asset classes.

Several factors should be considered when determining if bonds are suitable for your investment strategy. Your time horizon is key; if you have a long-term investment horizon, you may be able to tolerate more risk and allocate a larger portion of your portfolio to stocks. Conversely, a shorter time horizon may warrant a higher allocation to bonds. Your risk tolerance also plays a crucial role. If you’re uncomfortable with large fluctuations in the value of your investments, bonds can offer a more stable option. Finally, your overall financial goals should inform your investment decisions. If you’re saving for retirement, for example, a mix of stocks and bonds can be an effective approach.

Various types of bonds exist, each with its own characteristics and risk profile. Government bonds are issued by governments and are generally considered low-risk. Corporate bonds are issued by companies and typically offer higher yields but carry more risk. Municipal bonds are issued by state and local governments and offer tax advantages to certain investors. Understanding the differences between these bond types is essential for building a well-diversified bond portfolio tailored to your individual needs.

How to Buy Each Type

Purchasing different product types requires varying approaches. For physical goods like groceries or clothing, you typically visit a store or shop online, select your items, and proceed to checkout. Payment methods often include cash, credit/debit cards, or digital wallets. Be sure to inspect physical goods for damage before purchase, and keep your receipts for returns or exchanges.

Digital goods like software, ebooks, or online courses are purchased through online platforms. After selecting your desired product, you’ll usually be prompted to create an account or log in. Payment is often handled via credit card or online payment systems. Downloads and access are generally immediate or provided via email after the purchase is complete. Be sure to review the terms of service and refund policies before making your purchase.

Services such as haircuts, home repairs, or consulting require a different approach. You’ll typically contact the service provider directly to schedule an appointment or request a quote. Discuss your needs and expectations clearly before confirming the service. Payment methods may vary depending on the provider and can include cash, check, or online payments. Ensure you understand the service agreement and any associated guarantees or warranties.